How the transport and logistics industry in Kazakhstan is progressing: insights from the AIFC report

The AIFC has released an analytical report on Kazakhstan’s transport and logistics industry, indicating anticipated growth in investment and trade turnover driven by key players of the Eurasian continent such as the EU, China, India and Central Asia. This growth is expected to drive an increase in investment and trade turnover. Together, these countries constitute 40% of the global economy and 43% of the world’s population. Projections suggest significant economic expansion, particularly in India and Central Asia, accompanied by notable population increases in the near future.

The vast majority of trade between Asia and Europe occurs via sea routes. With international trade anticipated to rise among different regions of the Eurasian continent, particularly between Europe and East Asia, the Middle East and East Asia, and Europe and Southeast Asia, diversification of logistics capabilities could potentially divert some cargo traffic from maritime to overland routes.

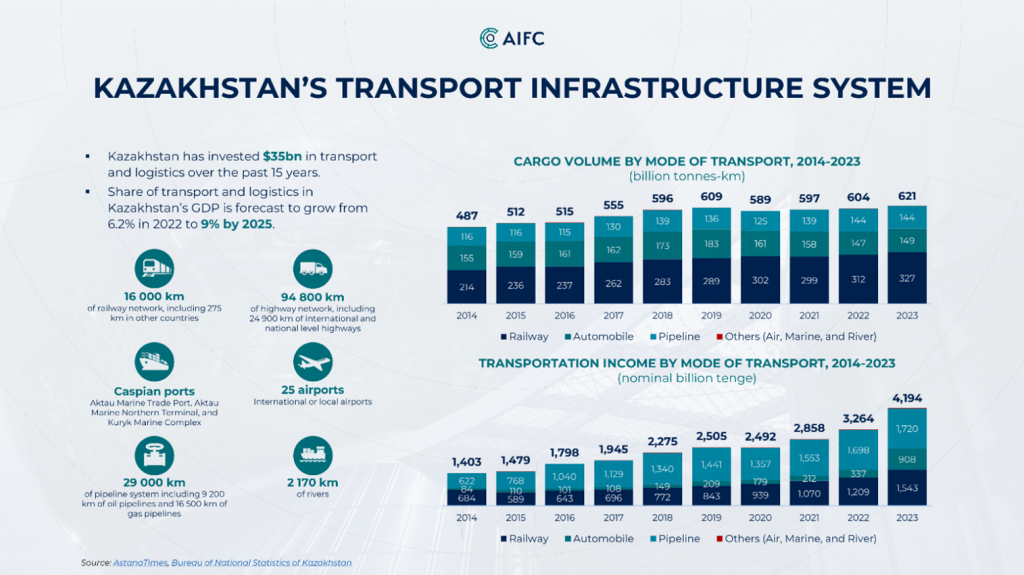

Among land routes, the Middle Corridor plays a significant role for Central Asia, demonstrating substantial growth in cargo volumes. As per World Bank projections, annual volumes along the Middle Corridor could triple to 11 million tons by 2030, propelled by economic expansion in Central Asia and the Caucasus. Over the last decade, cargo volumes in Kazakhstan have increased by 28% from 487 billion ton-kilometers in 2014 to 621 billion ton-kilometers in 2023.

Kazakhstan, positioned as a pivotal hub along the Middle Corridor and the North-South Corridor, is actively bolstering its transport capabilities. Over the last 15 years, Kazakhstan has invested $35 billion in transport and logistics infrastructure. Projections indicate that the contribution of transport and logistics to Kazakhstan’s GDP will rise to 9% by 2025.

Currently, railways serve as the key mode of cargo transportation in Kazakhstan, followed by roads and pipelines. Notably, the volume of railway freight transportation has experienced substantial growth in recent years, reaching 327 billion ton-kilometers in 2023. This growth persisted even during the peak of the Covid-19 pandemic in 2020.

In Kazakhstan, road transport constitutes a significant part of freight traffic, comprising 24% in 2022, and serves as the principal mode for over 90% of passenger traffic.

Sea freight volumes have witnessed a decline since their peak in 2011, primarily attributed to the substitution of oil export volumes via Caspian Sea ports with alternative transportation modes.

Kazakhstan’s aviation sector is rebounding from a three-year downturn attributed to the Covid-19 pandemic. In 2022, the volume of flights operated by foreign airlines through Kazakhstan’s airspace surged by nearly 2,5 times compared to 2021, surpassing 308 thousand (including both transit and landing flights) in 2023.

To address the growing cargo traffic demands, an expansion of infrastructure capacity, intensified marketing initiatives, and the establishment of further international agreements are imperative. According to the European Bank for Reconstruction and Development, an estimated €18,5 billion in total investment is necessary to substantially enhance the transport infrastructure of Central Asia and ensure sustainable connectivity, including the development of 33 infrastructure projects. Of these, 13 projects, totaling €5,5 billion, have been designated for Kazakhstan.

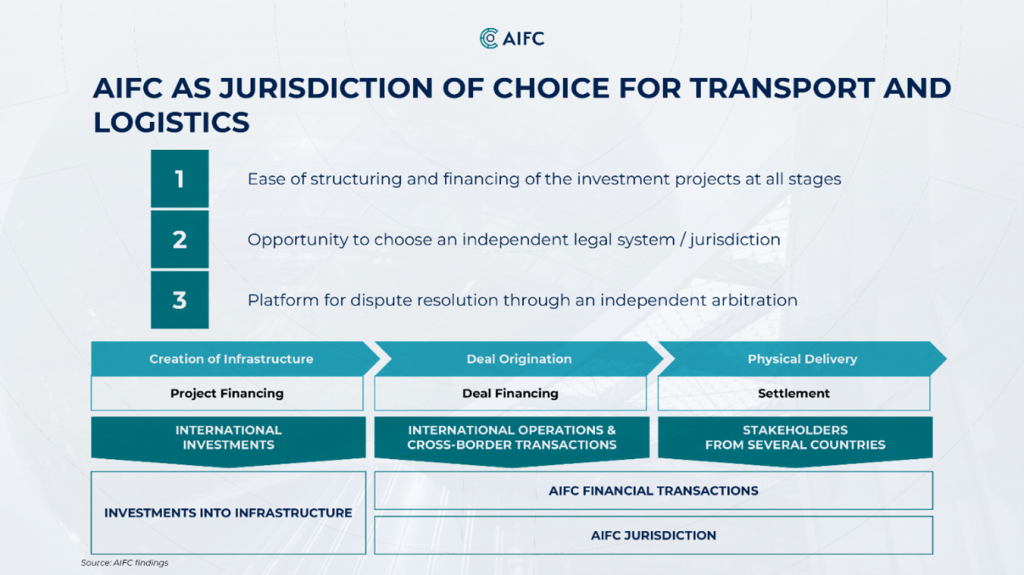

Currently, 66 transport and logistics companies are AIFC participants, with established joint ventures focusing on the advancement of the Middle Corridor project:

- Caspian Integrated Maritime Solutions Ltd, a joint venture of JSC NC KazMunayGas and Abu Dhabi Ports Group, that have already purchased oil tankers to increase transcaspian oil transportation.

- KPMC Ltd., a joint venture of JSC NC KTZ and PSA International (Singapore) to bring practical services in the field of information technology for the transport and logistics sector.

- Middle Corridor Multimodal Ltd., a joint venture involving JSC NC KTZ, Azerbaijan Railways CJSC and Georgian Railway JSC, to provide and implement a coordinated policy in multimodal and transportation and logistics services on the Trans-Caspian International Transportation Route.

Developing Middle Corridor projects at the AIFC site offers several advantages, including streamlined transaction structuring and investment project financing, access to an independent judicial system and regulatory frameworks aligned with international standards.

Meeting all the requirements of the country’s transport industry demands more than just investments and efficient transaction structuring mechanisms. It also necessitates enhanced tariff setting, digitalisation of processes, fostering public-private partnerships and fostering active international cooperation.

The report, prepared by experts from the AIFC Industry Analysis Department, aims to review and explore Kazakhstan’s transport and logistics sector, evaluating its potential while providing insights to the private sector, government bodies and the public regarding the industry’s state, trends and structure.

You can explore the report further by accessing it through this link.

Reference:

The Astana International Financial Centre (AIFC) is an independent jurisdiction with a favourable legal and regulatory environment and a developed infrastructure for starting and doing business, attracting investment, creating jobs and developing Kazakhstan’s economy. www.aifc.kz

AIFC Media Relations

Ainur Issabayeva

Press secretary

Phone: +7 701 777 6558

E-mail: [email protected]