AIFC to discuss issues on taxonomy of green projects for Kazakhstan

A round table discussion on the development of the Green Taxonomy and bills for the development of green finance in Kazakhstan was held at the site of the Center for Green Finance of the Astana International Financial Centre (AIFC).

The development of the Green Taxonomy of Kazakhstan is necessary for a more detailed specification of green projects, determining their content and the degree of “greenness”.

To develop the Taxonomy of Kazakhstan Tsinghua University proposed to adapt the Taxonomy of Mongolia, given the similarity of countries in terms of environmental and climatic parameters.

The round table participants discussed the finalization of this document for its subsequent adoption at the level of the AIFC rules for issuing green bonds and the possible introduction of green financing in Kazakhstan’s practice, in particular in the field of investment and lending to second-tier banks.

The discussion was attended by AIFC Managing Director Aidar Kazybaev, AIFC Green Finance Center Director General Asel Nurakhmetova, representatives of the Project Office of the Government of the Republic of Kazakhstan, Ministries of Ecology, Geology and Natural Resources, Energy, Finance, National Economy, the National Bank of Kazakhstan, Akimat of Nur-Sultan, international financial institutions, as well as non-governmental, research and financial community.

In addition, issues on the legal basis for the formation of a green finance system in Kazakhstan, as well as the revitalization of the green finance market, are sensitive matters on the agenda: it is important to clarify the definition in the field of green finance and to identify standards for identifying green financial instruments. In this regard, during this round table, the AIFC proposed draft amendments to the new Environmental Code of the Republic of Kazakhstan and related regulatory acts aimed at economic incentives for businesses to use green financing instruments.

To unify the conceptual apparatus at the legislative level in the field of green finance, it was recommended that the proposed definition of “green” financing, “green” projects, “green” bonds, “green” loans be included in the new Environmental Code of the Republic of Kazakhstan. At the same time, the drafts submitted for consideration in related normative legal acts in terms of subsidizing green bonds, green loans and, in general, issues of legislative and organizational consolidation of various forms of state support for green projects, including in the context of banking prudential regulation, bills related to investment and provision funds by second-tier banks, the expansion of the mandate of local authorities, are indicated as extremely relevant and requiring urgent activization of all involved state bodies and constructive interagency cooperation.

It was recommended to use the platform of the Project Office of the Government of the Republic of Kazakhstan for conducting cross-functional meetings on an ongoing basis to discuss these issues and to allocate areas of responsibility with the involvement of all involved government bodies and departments.

It is also worth noting that the Astana International Exchange previously adopted the Rules for the issue of green bonds. These Rules determine the categories of green projects, compliance with which is a requirement for the issuer of green bonds upon receipt of admission to circulation on the AIX and disclosure of information. This categorization is based on the International Principles of Green Bonds and the Climate Bonds Taxonomy as stated in the Climate Bonds Initiative Standard.

Reference:

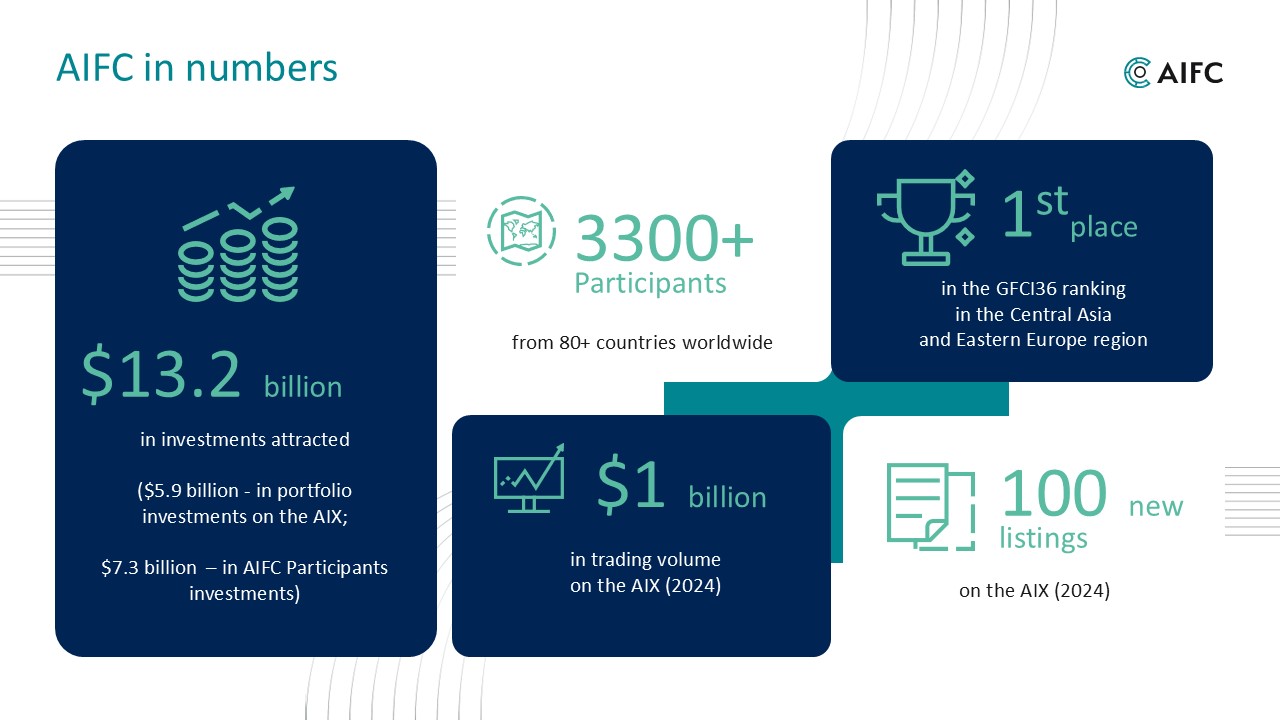

AIFC. The Astana International Financial Center (AIFC) was created on the initiative of the First President of the Republic of Kazakhstan, Elbasy Nursultan Nazarbayev. The constitutional law “On the AIFC” was signed on December 7, 2015. AIFC’s goal is to form a leading center of financial services at the international level. AIFC objectives are to assist in attracting investment in the country’s economy, create an attractive environment for investing in financial services, develop the securities market of the Republic of Kazakhstan and ensure its integration with international capital markets.