The AIFC Tech Hub held a presentation of the guide “VC Guide for Founders”

The AIFC Tech Hub held an official presentation of the guide “VC Guide for Founders” in partnership with KPMG and SkyBridge Invest. The global venture capital fund MyVentures has become the corporate partner of the official presentation of the guide.

The purpose of the guide is to provide a clear understanding of the opportunities and advantages of the Astana International Financial Center (AIFC) for structuring venture transactions and attracting investments. The guide was based on interviews with the founders of Kazakhstan startups and business angels.

At the event, the speakers discussed the ecosystem of venture capital industry, talked about the benefits of structuring venture deals within the AIFC, and shared their personal experience of creating startups in Central Asia.

Nazgul Baitemirova, an expert on structuring of the VC Support AIFC Tech Hub department, commented: “Due to principles of freedom of contract and flexibility of jurisdiction, the AIFC allows using such traditional venture capital instruments, which are already widely used in the Western world. For example, the possibility of structuring transactions through debt instruments as convertible loan, and conditional debt instruments SAFE and KISS”.

Sholpan Ainabayeva, the managing director at SkyBridge Invest, told: “On the basis of the AIFC conditions are created for the correct and competent release of financial instruments within the framework ESG, structures are created that allow for conduct correct verification and correct positioning of financial instruments that are issued under these principles.”

Inna Alkhimova, partner, Head of Tax and Legal KPMG in Central Asia, said: “Until recently, popular holding jurisdictions were the Netherlands, Singapore, Luxembourg and Cyprus. Recently, we have seen increased interest to the AIFC site due to a few factors: English law, a variety of legal forms that are available for registration, low maintenance costs and a favorable tax regime for investors, as for Kazakhstani, and for foreign”.

Alexey Girin, the General Partner at Starta Capital noted: “In Kazakhstan we are registering a subsidiary company Starta Capital. You had a gut feeling with the formation of the AIFC with English jurisdiction. I think you have found your moment. Many startups in our ecosystem are asking about Kazakhstan, some of the teams from the portfolio companies have been relocating to Kazakhstan in the last month and a half.

Konstantin Sinyushin, the Untitled Venture Company Managing Partner, added: “Kazakhstan has an absolutely fantastic thing that cannot be found in those countries where the exodus took place, and not even in continental Europe, except Cyprus. We are talking about the AIFC with structuring of the companies by the English law. It is a fantastic achievement”.

Shakhboz Rakhmanov, General Partner at MyVentures, said that the experience of investing in Central Asian projects has shown that the market is ready to create positive-disruptive products. “In the current conditions, the AIFC with the jurisdiction based on the principles of English common law has become a big trump card for the projects”, Rakhmanov noted. According to Rakhmanov, “Our fund is at the pre-seed/seed stage, so we are looking at startups at those same stages. We are focused mainly on the market of Kazakhstan and Central Asia.

The speakers of the event were also an angel investor, technology entrepreneur Murat Abdrakhmanov, Investment Director of Quest Ventures Ruslan Rakymbay, BILLZ founder Rustam Khamdamov, CEO of Cerebra.ai Ltd. Doszhan Zhusupov and many others.

The full version of the survey is available here: https://tech.aifc.kz/reports/

The event recording is available here: https://www.youtube.com/watch?v=2DFIW_2tUj8

Reference:

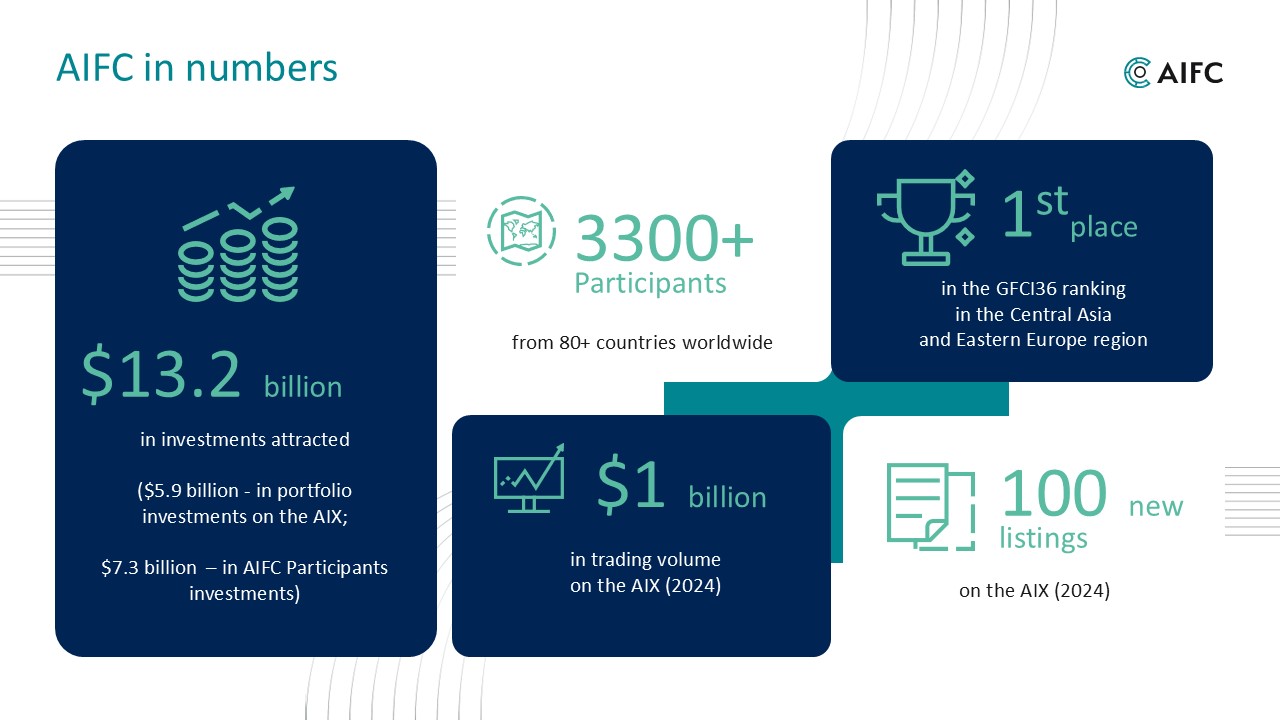

The Astana International Financial Centre (AIFC) is an independent jurisdiction that started operations in 2018. In accordance with the Development Strategy until 2025, the key focus of the AIFC is to consolidate as a universal platform connecting the countries of the EAEU, Central Asia and the Caucasus. www.aifc.kz

AIFC Tech Hub is a subdivision of the “Astana” International Financial Center (AIFC), which has the task of promoting the development of the start-up ecosystem, the venture industry market, e-commerce, corporate innovation and new technological directions in Kazakhstan (FinTech, GovTech, SatelliteTech, Industry 4.0. etc.). Together with international partners, Tech Hub conducts support programs for market players, promotes structuring of venture deals and testing of new fintech solutions within the regulatory sandbox of AIFC’s jurisdiction. www.tech.aifc.kz

KPMG is a global network of professional firms providing Audit, Tax and Advisory services, operating in 147 countries with more than 219,000 people working in member firms around the world. Our purpose is to turn knowledge into value for the benefit of our clients, our people, and the capital markets.

KPMG is committed to three key imperatives: quality of services, insight into the problems of our clients, and integrity in our business. It is these principles that drive our firms’ professionals to provide audit, tax, and advisory services that reflect global consistency and unwavering integrity. We will build and sustain our reputation as the best firm to work with by ensuring that our people, our clients and our communities achieve their full potential.

SkyBridge Invest is a financial advisor with extensive experience in executing large and complex transactions in organized and unorganized capital markets. To organize capital raising in business, the company has a qualified team, experience and a vision focused on the needs of the issuer, a database of projects and investors for direct investment in capital, skills in assessing financial risks and the fair value of the business and funding. In addition to supporting transactions for arranging financing in the capital markets, SkyBridge Invest provides consulting services at all stages of mergers and acquisitions (M&A), assisting clients in the most efficient sale of a business and searching for investment objects.

MyVentures is a $20 million global venture fund investing in early-stage technology startups that are shaping the industries of tomorrow. We focus on markets where technology, innovation and capital can create long-term value and drive economic growth.