AFSA introduced financial market support measures in response to the global COVID-19 pandemic

AFSA, the regulator of the Astana International Financial Centre, introduced a number of targeted measures to support AIFC participants, ensure market integrity and financial stability. These measures are designed to alleviate the negative impact on regulated firms due to the exceptional circumstances caused by COVID-19.

The regulator has revised plans for the submission of mandatory reports that are not critical to market integrity in the short term. This will allow companies – market participants – to focus on customer support and their business activities in this difficult period.

One of the immediate steps that AFSA has taken was the extension of the deadlines for submitting various types of mandatory reporting for 30 calendar days after the end of the state of emergency in Kazakhstan. Details can be found on the official website of the regulator here.

It is worth emphasizing that the regulator is operating in business as usual mode and continues performing supervision over the financial markets. AFSA employees work remotely and have all the necessary digital solutions for timely and efficient processing of requests and meetings with AIFC participants and consumers of financial services.

All financial services and AIFC platforms remain open and accessible to market participants. This includes the AIX, International Exchange of AIFC, which has continued to function smoothly from the start of the pandemic.

AFSA also maintains regular contacts with national regulators, foreign peer regulators and international standard setting organisations to ensure the efficient supervision of financial markets, cross-border transactions and coordinate responses to COVID-19 impacts. AFSA actively participates in ongoing discussions of possible regulatory actions in connection with COVID-19 and consumer protection measures on margins of IOSCO, IAIS, FinCoNet and others.

At the same time, AFSA draws the attention of Authorised Person to the importance of complying with requirements for systems and controls, particularly for policies on risk management, cyber-security and business continuity, and on ensuring the financial and operational resilience.

AFSA expects that prudentially regulated firms will actively manage their liquidity and should immediately report to the AFSA if there are reasons to believe the firm will be in difficulty. AIFC capital and liquidity requirements are benchmarked to international standards of Basel III and should ensure resilience to economic stress.

All Authorised Persons should immediately inform the AFSA of any significant developments and matters that could impact their ability to meet regulatory requirements.

AFSA is firmly committed to its regulatory mission and welcomes the timely actions of the Government of Kazakhstan and the National Bank of Kazakhstan to support the economy.

As the situation with the COVID-19 pandemic develops, the regulator plans to introduce new response measures for the effective functioning of the financial markets. AFSA will report all updates as they become available.

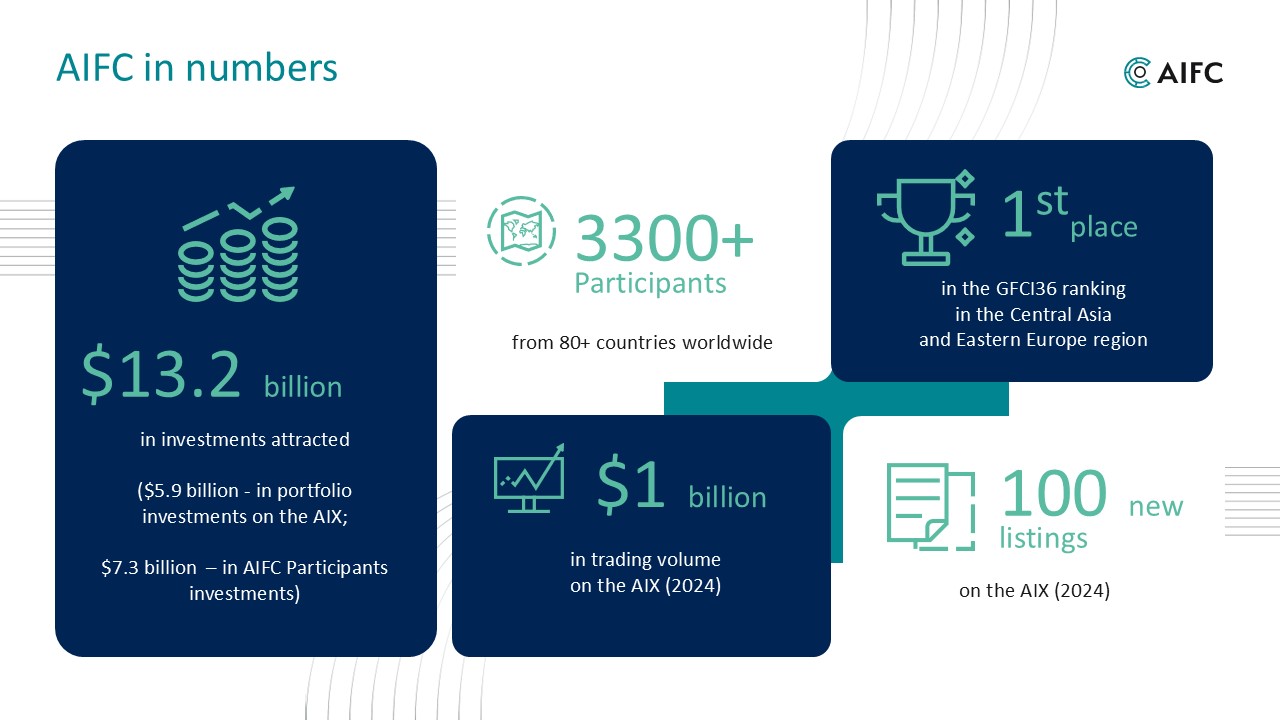

It is worth recalling that to date, 438 companies are registered in the AIFC. Since the beginning of the year, AIFC registered 75 new participants. These companies represent 40 countries, including the companies from Kazakhstan, Russia, China, Great Britain, the USA, India, Finland, Singapore, the United Arab Emirates, the Netherlands, Turkey, Switzerland, Germany, Italy and many others.