Astana Financial Services Authority introduces simplified authorisation procedures for certain regulated activities

Astana Financial Services Authority (AFSA) has simplified procedures for obtaining a licence for certain types of regulated activities. This reflects AFSA’s general approach to constantly evolve regulatory environment towards business-friendly principles and risk-based supervision.

Application process has been simplified in relation to six regulated activities: (1) advising on investments, (2) arranging deals in investments, (3) advising on a credit facility, (4) arranging a credit facility, (5) insurance intermediation (without Client Money) and (6) insurance management.

AFSA has significantly simplified the application form and excluded requirements to provide certain documentation following requests from potential participants to simplify AFSA’s processes and requirements.

A new simplified application form is tailored for the regulated activities mentioned above and yet provides AFSA with key information necessary for discharging its regulatory functions.

In addition, the AFSA has also developed guidelines to assist firms intending to carry on regulated activities in the AIFC with developing the required policies and procedures (compliance, risk management, AML/CFT, controls and procedures, business continuity, conflicts of interest).

Guidelines provide an indication of AFSA’s minimum expectations and outline key points that should be included in a firms’ policies and procedures.

In addition, the guidelines provide links to publications of international standard setting bodies that might be useful for the establishment of the firm’s own policies depending on the type of proposed business.

These moves are intended to facilitate firms to make a decision on establishing a presence in the AIFC, help to establish their own systems and controls and thus aid firms through the authorisation process.

(Link to the simplified Application Form)

Reference:

AFSA is the independent regulator of the Astana International Financial Centre (“AIFC”), which is established in accordance with the Constitutional Law of the Republic of Kazakhstan “On the Astana International Financial Centre” for the purposes of regulating activities related to financial services in the AIFC. As such the AFSA administers the AIFC Regulations and Rules, which provides, among other things, for the authorization, registration, recognition and supervision of financial firms and market institutions.

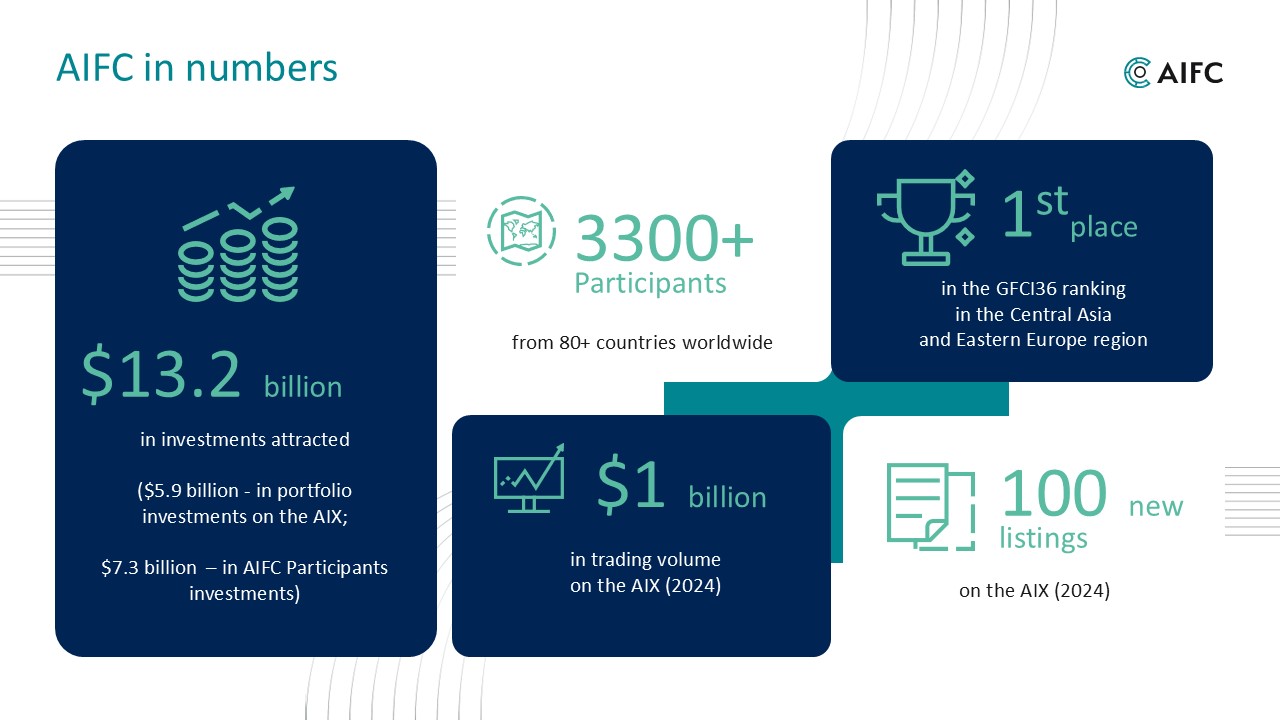

AIFC. In December 2015 President of the Republic of Kazakhstan Nursultan Nazarbayev signed the Constitutional law “On the Astana International Financial Centre” (AIFC). The aim of the AIFC is to form a leading international centre of financial services. For the first time in post-Soviet Region, Common law framework will be introduced in the AIFC. English shall be the official language of the AIFC.

The objectives of the AIFC are to attract investment into the economy through the establishment of an attractive environment for investment in the financial services, to develop local capital markets, to ensure their integration with the international capital market, and to develop markets for insurance and banking services and for Islamic financing in the Republic of Kazakhstan.