Green Finance in Focus: How Kazakhstan is Advancing Towards a Sustainable Energy Transition

On November 30, the 28th Conference of the Parties to the UN Framework Convention on Climate Change (COP28) commenced in Dubai, uniting 140 Heads of State and Government along with more than 70,000 delegates.

During the conference, heads of state and government deliver “national addresses” presenting their countries’ vision on the most pressing climate change issues. Kazakhstan actively participates in the event, showcasing strategies and innovative approaches to sustainable development, and emphasizing the importance of sharing experiences and collaborative efforts to achieve global goals.

The conference program spans various sectors, including health, trade, aid, recovery and achieving peace. Key themes such as technology and innovation, inclusion, climate change, and finance challenge participants to engage effectively and work closely together across countries.

Under the COP28 framework, the Astana International Financial Centre is actively promoting several events aimed at fostering climate finance and supporting a sustainable energy transition in Central Asia.

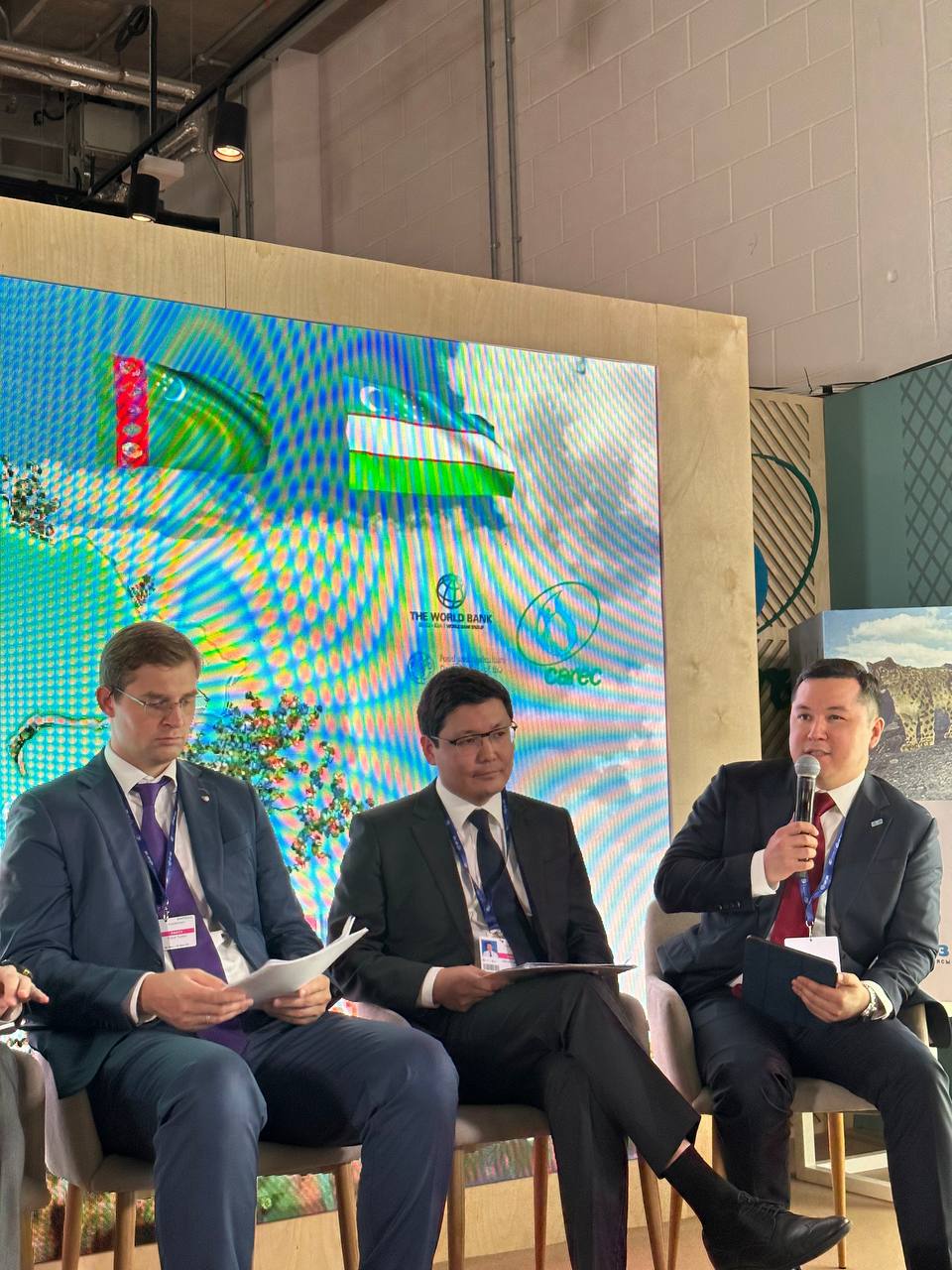

The session “Attracting investments for sustainable energy transition and the role of international financial institutions” was a pivotal event organized by AIFC. Renat Bekturov, AIFC Governor and the session’s moderator, underscored the significance of global cooperation: “We all understand that the challenges of the climate change and decarbonization are global, so our efforts have to be global as well. We need a lot of investments in clean and renewable technologies, sustainable infrastructure and innovative solutions.”

Representatives from major companies, development institutions, and financial players, such as JSC NC KazMunayGas, Eurasian Group LLP, Eurasian development bank, Development bank of Kazakhstan, Freedom Holding Corp., and others actively participated in the panel session. During the session, they shared insights into their experiences and outlined plans to reduce carbon footprints and attract green investments.

Timur Turlov, the CEO of Freedom Holding Corp., has stated that the company plans to invest KZT 200 billion in ESG bonds until 2027. He also mentioned that investments are planned both internationally and locally. In February 2023, Freedom Finance entered into a partnership agreement with the International Fund for Saving the Aral Sea in Kazakhstan. The company provided 16.6 million tenge to finance the project coordinated by “Qazaq Carbon”.

The side event titled “Green pitching for Central Asia: investment in sustainable development and climate resilience” was strategically designed to promote green initiatives in Central Asia.

By showcasing innovative projects addressing climate challenges and fostering economic growth, the event emphasized Central Asia’s role in global climate action, presenting a potential model for other regions facing similar issues. The TEDx-inspired Green Pitching session focused on key thematic blocks such as energy, water, biodiversity, sustainable agriculture and infrastructure, featuring presentations from representative organizations of each Central Asian country to unveil investment opportunities and eco-innovative solutions in their respective regions.

Also within the framework of the “green” pitching, a memorandum of understanding and cooperation on green finance was signed between the AIFC Green Finance Center (GFC) and Akia Avesta Automotive Industry LLC. This is the first and only company in Tajikistan that produces buses and electric buses according to international standards. The company intends to attract investments, including through the placement of green bonds on stock exchanges.

The next AIFC session: “On the path to achieving climate ambitions: Development of carbon markets in Central Asia” was inaugurated by Kazakhstan’s Minister of Ecology and Natural Resources, Yerlan Nysanbayev. In his welcoming remarks, he emphasized that in order to achieve carbon neutrality, a key role should be given to the development of regional carbon markets. According to the Minister, the development of the carbon market and achieving the high goals of the Paris Agreement is impossible without partnership and effective cooperation between the countries of the region. Thus, in 2023, a cooperation agreement was signed between Kazakhstan and Japan on a joint crediting mechanism. He also emphasized the importance of partnership in terms of implementation of climate projects, transfer of green technologies and creation of new jobs.

On the international experience in the field of carbon markets, as well as the ongoing work of Japan to launch an emissions trading system (ETS) told the Vice-Minister for International Environmental Relations of Japan Matsuzawa Yutaka.

The discussion centered on the evolution of carbon markets and evaluating their alignment with global climate objectives. The session underscored the significance of ongoing dialogue and the incorporation of innovative elements into both regulated and voluntary markets to robustly contribute to carbon neutrality in Central Asia and the broader region.

COP28 incorporated an event dedicated to transition finance, showcasing a transition finance policy report that analyzed current approaches in this topic. The panel session on transitional finance in Central Asia received particular focus, engaging in discussions on leading practices, challenges and prospects in the region. Speakers like Cheng Lin, head of the secretariat of the GIP Beijing office and Helga Bridgen, global chair for sustainable investments at Mercer, shared their visions and recommendations during this insightful session.

The signing ceremony of the declaration of accession of Damu entrepreneurship development Fund to the Green Investment Principles (GIP) marked a significant stride in enhancing collaboration and dedication to green investments. The AIFC Green Finance Centre, acting as the regional office for the Green Investment Principles for the Belt and Road Initiative in Central Asia, played a co-organizing role in this event. This underscores the centre’s pivotal role in supporting sustainable initiatives within the region.

Established in 2018, the Green Finance Centre plays a pivotal role in facilitating the transition to a low-carbon economy. Over half of Kazakhstan’s green bonds and loans issued to date have had the Centre’s involvement, showcasing its substantial impact. The Centre offers a comprehensive range of services, including policy development, pre-issuance reports and annual project impact reports. Actively engaged in the development of sustainable finance instruments, the Centre stands out as a key player in the regional sustainable finance ecosystem.

In its commitment to a sustainable future, Kazakhstan will persist in developing and implementing green financial mechanisms, offering an effective pathway to a green economy. The adoption of the Carbon Neutrality Strategy 2060 earlier this year and Kazakhstan’s active participation in COP28 underscore the country’s significant progress in sustainable development and the global fight against climate change.