The potential volume of new Islamic deposits in Kazakhstan is estimated at 2.8 trillion tenge

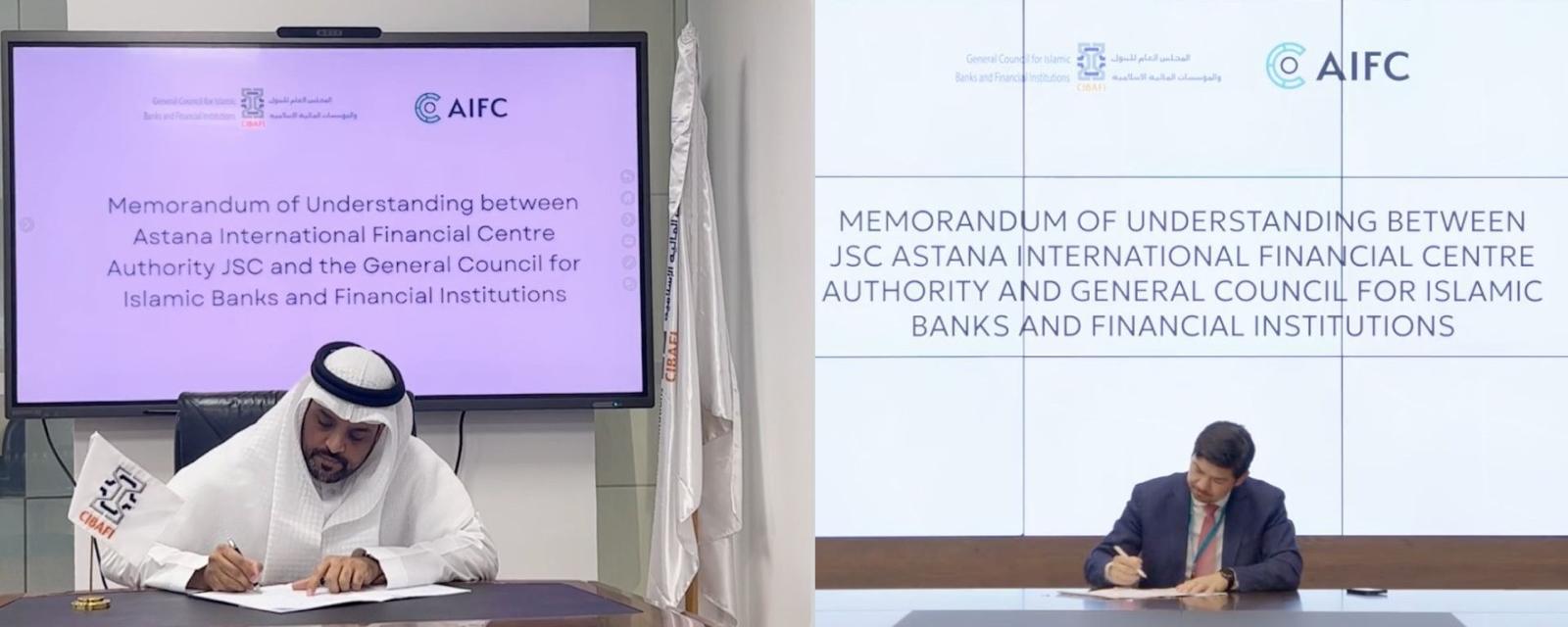

The volume of new Islamic deposits in Kazakhstan may reach 2.8 trillion tenge. Such data was announced at the Astana International Financial Center (AIFC, Centre) as part of the presentation of a report on the market for the development of Islamic finance in Kazakhstan.

The report was prepared by the consulting company CSQLaw, a licensed AIFC participant, with the support of the Islamic Development Bank Institute. The survey aimed to evaluate the market demand for Islamic financial products among retail and corporate clients in Kazakhstan. The survey involved around 13,000 participants from Kazakhstan, including 350 legal entities and over 12,000 individuals.

According to the survey, some individuals who were previously not part of the deposit system due to religious beliefs have indicated their willingness to open an Islamic deposit. The total value of these new Islamic deposits could reach up to 1.9 trillion tenge. Additionally, the study estimates that the transition from conventional to Islamic deposits could be worth around 924 billion tenge.

The same high figures were obtained from the survey results for other types of financing. Thus, the volume of Islamic mortgages at market rates is estimated at 1.6 trillion tenge, and the potential volume of Islamic financing, including consumer financing, car financing and instalment plans, is estimated at more than 2.3 trillion tenge.

The survey revealed a high demand for various Islamic financial instruments. This demand is increasing, especially due to the growing number of Muslims who can’t use conventional banking instruments because of their religious beliefs. However, it is important to note that Islamic finance is not only for Muslims. Anyone can use this alternative financing method, regardless of religious beliefs.

Despite the increasing market demands, the survey found relatively low awareness of Islamic financial products in all regions of Kazakhstan. In fact, 85% of survey participants (individuals) have never used Islamic finance products. The reasons behind this are the unavailability of these products, lack of recommendations, misconceptions about Islamic finance, and trust issues.

Daniyar Kelbetov, Chief Product Officer of AIFC Authority, noted: “Islamic finance is an important area of development for the AIFC. The necessary conditions for the operation of Islamic financial institutions in retail and corporate sectors have been established in Kazakhstan. The Centre has developed the required legal framework for functioning Islamic financial products. It collaborates closely with the Islamic Development Bank, the Asian Development Bank, and other organisations. The National Bank of the Republic of Kazakhstan and the Agency of the Republic of Kazakhstan for Regulation and Development of the Financial Market also support the development of this area. The findings of this survey will help to get a more comprehensive understanding of the Islamic finance market in Kazakhstan and determine the focus of further work”.

Shamsul Qamar, the managing partner of CSQLaw, emphasised: “Since our involvement in the AIFC in 2019, we have been committed to developing Islamic finance in Kazakhstan, and the financial centre has provided us with an excellent opportunity to do so. We have received numerous inquiries from foreign banks and companies regarding the market for Islamic financial products and services in Kazakhstan. I am confident that the findings of this survey will help attract new players from Malaysia and Southeast Asia to the market. We hope that the positive changes occurring in the financial industry will also be successful in the market for Islamic financial products and services “.

It is worth noting that the list of financial services available to residents of Kazakhstan has recently been expanded. As of February this year, AIFC participants can provide Islamic financing services to individuals and legal entities in any currency. These services can now be offered not only by Islamic banks and insurance companies of the AIFC but also by Islamic financial organisations. The available services include consumer financing, instalment financing, Islamic leasing, trade financing, and financing in accordance with the principles of Shari’ah law.

The AIFC, in collaboration with the National Bank of the Republic of Kazakhstan and the Agency of the Republic of Kazakhstan for Regulation and Development of the Financial Market, has made changes and additions to the AIFC Rules on Currency Regulations and Provision of Information on Currency Transactions in the AIFC.

With the establishment of licensed Islamic financial organisations at the AIFC site, the range of instruments available to residents of the Republic of Kazakhstan, including SMEs, will be expanded. This expansion will contribute to developing the country’s real sector and economy.

Islamic banks, Islamic financial companies, asset management companies, Islamic brokerage dealer companies, and Islamic insurance companies (takaful and retakaful) are now eligible to become participants of the AIFC.

To attract companies to AIFC, the minimum authorised capital requirements for Islamic banks and financial organisations have been reduced until May 2026. Additionally, financial companies licensed by the AIFC regulator are exempt from paying CIT and VAT, including Islamic banking, non-banking, Islamic insurance, and reinsurance companies.

You can find more information about the development of the Islamic finance market in Kazakhstan by following this link.

Reference:

According to a sociological study titled “Assessment of State Policy in the Religious Sphere by the Population of Kazakhstan” conducted in 2021 by the Ministry of Information and Social Development of the Republic of Kazakhstan, about 19.5% of the population aged 18-65 years practice Islam, which amounts to approximately 2.25 million people. The Sajda application helped distribute the online survey, and it was found that a similar number of practicing Muslims from Kazakhstan are registered on this platform.

The Astana International Financial Centre (AIFC) is an independent jurisdiction with a favourable legal and regulatory environment and a developed infrastructure for starting and doing business, attracting investment, creating jobs and developing Kazakhstan’s economy. aifc.zuweb.co

AIFC Media Relations

Ainur Issabayeva

Press secretary

Phone: +7 701 777 6558

E-mail: [email protected]