The List of financial services provided by the AIFC participants, income from which is exempt from CIT and VAT (full text)

BackThe List of financial services provided by the AIFC participants, income from which is exempt from Corporate Income Tax and Value Added Tax

-

JOINT ORDER

JOINT ORDER

On approving the List of financial services provided by participants of the Astana International Financial Centre, the income from which is exempt from payment of corporate income tax, value-added tax

Pursuant to subparagraph 5) of paragraph 3 and paragraph 8-2 of article 6 of the

Constitutional Statute of the Republic of Kazakhstan On the Astana International Financial Centre dated 7 December 2015, WE DO HEREBY ORDER AS FOLLOWS:

1. The List of financial services provided by participants of the Astana International Financial Centre, which are exempt from payment of corporate income tax and value-added tax as attached in Annex to this order is approved.

2. The Governor of the Astana International Financial Centre shall be charged with supervising the execution of this Joint order.

3.This Joint Order commences on the day of its signing by the parties.

-

Chapter 1. General provisions

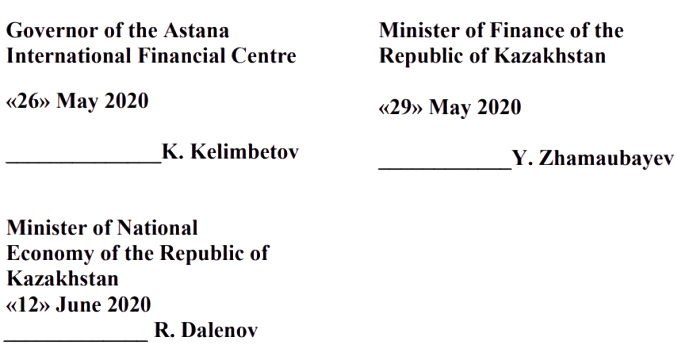

Annex to

the Joint Order of the Governor of the

Astana International Financial Centre as of «26» May 2020

№ 126,

Minister of Finance of the Republic of

Kazakhstan as of «29» May 2020

№ 547,

and Minister of National Economy of the

Republic of Kazakhstan as of «12» June 2020

№ 118The List of financial services provided by the Astana International Financial Centre participants, income from which is exempt from corporate income tax and value-added tax

Chapter 1. General provisions

1. The List of financial services provided by the Astana International Financial

Centre (the AIFC), which are exempt from corporate income tax and value-added tax (the List) is developed in accordance with subparagraph 5) of paragraph 3 of article 6 of the Constitutional Statute of the Republic of Kazakhstan On the Astana International Financial Centre (the Constitutional Statute) dated 7 December 2015 in order to apply paragraphs 3 and 8-2 of article 6 of the Constitutional Statute.

2. The List applies to legal entities registered under the Acting Law of the AIFC and legal entities recognised by the AIFC as AIFC Participants, and are binding on them in case of the application of paragraphs 3 and (or) 8-2 of article 6 of the Constitutional Statute. -

Chapter 2. General terms used in the List

3. For the purposes of applying the List, the following general terms and abbreviations are used:

1) securities – shares, stakes, debt securities, units in investment funds, Islamic securities, derivatives and other securities determined by the AIFC Acts;

2) bank account – a correspondent account, current account, savings account;

3) securities settlement system – a system which enables investments held in accounts to be transferred and settled by book entry according to a set of laws and predetermined multilateral rules to provide legal certainty

4) investment – securities, derivatives or digital asset, as well as a right or interest in the relevant security, derivative or digital asset;

5) investment crowdfunding platform – an electronic platform that facilitates the bringing together of potential investors and issuers to provide issuers funding for a business or project from investors;

6) investment fund – a fund created for the purpose of collective investment scheme;

7) Islamic financial contracts-Murabahah (selling a product at a price equal to the cost of the product plus a mark-up), Ijarah (Islamic leasing), Mudaraba (a type of equity participation in a business where one of the parties provides capital and the other party conducts business for a certain part of the profit, measured in an equity proportion), Musharakah (a partnership agreement in which two or more parties provide capital and perform management), Wakala (an agency agreement) and other types of Islamic financial contracts determined by AIFC Acts;

8) Islamic financing – financing based on one or more Islamic financial contracts;

9) clearance – transmitting and reconciling orders prior to settlement and establishing settlement positions, including the calculation of net positions arising from a transaction in investments;

10) loan crowdfunding platform – an electronic platform that that facilitates the bringing together of potential borrowers and lenders; 11) administering a loan agreement includes: providing information or performing other duties under a loan agreement on

behalf of the Borrower or the lender; taking steps to obtain the repayment of a loan;

exercising rights or performing obligations under a loan agreement on behalf of

the Borrower or the lender;

12) profit sharing investment account – an account or portfolio in relation to property of any kind, including the currency of any country or territory, held within an account or portfolio, which is managed under the term of an agreement and simultaneously meets the following conditions: the investor agrees to share any profit with the manager of the account or portfolio in accordance with a predetermined specified percentage or ratio, and the investor agrees that he alone will bear any losses in the absence of negligence or breach of contract on the part of the manager;

13) restricted profit-sharing investment account – a profit sharing investment account under which the investor sets certain investment restrictions for the manager of the account;

14) retakaful – Islamic reinsurance;

15) trustee – a person who owns property transferred to a trust and provides services related to trust and other fiduciary operations in respect of an established trust for the benefit of the beneficiaries or for the benefit of a particular purpose;

16) takaful – Islamic insurance;

17) trust — the beneficiary’s right to benefit from the property, the ownership of which is transferred by the settlor to the Trustee based on a contractual relationship (trust agreement);

18) collective investment scheme – an arrangement with respect to property of any description, including funds, the purpose or effect of which is to enable persons taking part in the arrangements (whether they become owners of the property or any part of it or otherwise) to participate in receiving profits or income arising from the acquisition, holding, management or disposal of the property or sums paid out of such profits or income; 19) Electronic platform – a website or other form of electronic media.

20) digital asset – a digital representation of value that can be digitally traded and functions as a medium of exchange and functions as a unit of account or a store of value; can be exchanged back-and-forth for money (fiat currency), but is neither issued nor guaranteed by the government of any jurisdiction; fulfils the above functions only by agreement of users of the digital asset and accordingly is to be distinguished from money (fiat currency) and e-money.

4. Other terms of tax, civil and other branches of legislation of the Republic of Kazakhstan used in the List are applied in the same manners as they are used in these branches of legislation of the Republic of Kazakhstan, unless otherwise provided by the Constitutional Statute, AIFC Acts and (or) the List. -

Chapter 3. The List of financial services provided by AIFC participants, the income from which is exempt from the payment of corporate income tax and value-added tax

5. Financial services provided by AIFC Participants that are exempt from corporate income tax and value-added tax include the following:

1) Dealing in Investments as Principal – buying, selling, subscribing for or underwriting any Investment as principal;

2) Dealing in Investments as Agent –buying, selling, subscribing for or underwriting any Investment as agent;

3) Managing Investments –managing on a discretionary basis asset belonging to another Person where the assets include any Investment;

4) Managing a Collective Investment Scheme (managing an investment fund) – establishing, managing, or otherwise operating or winding up a Collective Investment Scheme.

Managing a Collective Investment Scheme may include the following: Managing Assets, Providing Fund Administration, Dealing as Agent, Dealing as Principal,

Arranging Deals in Investments or Providing Custody;

5) Providing Custody – safeguarding and administering Investments belonging to another Person; safeguarding and administering Fund Property; safeguarding and administering digital assets belonging to another Person;

6) Arranging Custody –arranging for one or more Persons to carry on the Regulated Activity of Providing Custody and may include:

collecting and processing customer payments;

disclosure and settlement of agreement terms between the custodian and the

Person who receives the custody; transmitting information between the custodian and the client;

7) Providing Trust Services –the provision of services with respect to the creation of an express trust, arranging for any Person to act as a trustee in respect of any express trust, acting as trustee in respect of an express trust, acting as protector or enforcer in respect of an express trust;

8) Providing Fund Administration –providing one or more of the following services in relation to a Fund:

processing dealing instructions including subscriptions, redemptions, stock transfers and arranging settlements and valuing of assets and performing net asset value calculations; maintaining the share register and Unitholder registration details;

performing anti money laundering requirements; undertaking transaction

monitoring and reconciliation functions; performing administrative activities in relation to banking, cash management,

treasury and foreign exchange; producing financial statements, other than as the Fund’s registered auditor; communicating with participants, the Fund, the Fund Manager, and investment managers, the prime brokers, the Regulator and any other parties in relation to the administration of the Fund;

9) Acting as the Trustee of a Fund –holding the assets of a Fund on trust for the Unitholders where the Fund is in the form of an Investment Trust, may include Providing Fund Administration and(or) Providing Custody;

10) Advising on Investments – giving advice to a Person in his capacity as an investor or potential investor on the merits of his buying, selling, holding, subscribing for or underwriting a particular Investment;

11) Arranging Deals in Investments –making arrangements with a view to another Person buying, selling, subscribing for or underwriting an Investment.

Arranging Deals in Investments may include collecting and processing fees, contributions, and other payments, assisting an Issuer in placing securities and investors in subscribing to securities, agreement and settlement of terms of contractual relations between the Issuer and investors, transmitting instructions or confirmations regarding transactions;

12) Managing a Restricted Profit Sharing Investment Account –managing an account or portfolio which is a Restricted Profit Sharing Investment Account based on Islamic Financial Contract;

13) Islamic Banking Business – providing financing or making Investments by entering as principal or agent into any Islamic Financial Contract through raising, accepting and managing funds or money placements, or managing Unrestricted Profit Sharing Investment Accounts provided that all such activities are carried out in a Shari’ah-compliant manner;

14) Providing Islamic Financing –providing financing by entering into any

Islamic Financial Contract;

15) Insurance Intermediation –performing the duties of a principal or agent in relation to the buying or selling of Contract of Insurance with a view to another Person, advising on a Contract of Insurance, making arrangements with a view to another Person, whether as principal or agent, buying a Contract of Insurance;

16) Accepting Deposits –accepting money or funds received as a Deposit if that money or funds are lent to other Persons or used to finance wholly, or partly, any other activity of the Person accepting the Deposit.

Accepting Deposits may include Opening and Operating Bank Accounts;

17) Providing Credit –providing a Credit Facility to another Person;

18) Advising on a Credit Facility –giving advice to a Person in his capacity as a borrower or a potential borrower, on the merits of his entering into a particular Credit Facility;

19) Arranging a Credit Facility –making arrangements for the provision of a Credit Facility by one or more Persons.

The service may include collecting and processing commissions, fees, and other payments, assisting the lender in placing funds and the borrower in obtaining credit facility, agreement and settlement of the terms of the contractual relationship between the lender and the borrower; transmission of instructions or confirmations concerning credit facility;

20) Providing Money Services includes:

providing currency exchange;

selling or issuing payment instruments including payment cards;

selling or issuing stored value instruments;

execution of payment transactions, including transfers of funds on a settlement account, including a bank account, with the user’s payment service provider or with another payment service provider – execution of direct debits, including one-off direct debits or execution of payment transactions through a payment card or a similar device; execution of payment transactions where the funds are covered by a credit line for a payment service user – execution of direct debits, including one-off direct debits or execution of payment transactions through a payment card or a similar device; money remittance;

execution of payment transactions where the consent of the payer to execute a

payment transaction is given by means of any telecommunication, digital or IT device and the payment is made to the telecommunication, IT system or network operator, acting only as an intermediary between the payment service user and the supplier of the goods and services;

issue and repayment of electronic money;

sale (distribution) of electronic money and(or) stored value instruments, including

payment cards; receiving and processing payments made using electronic money; receiving cash for crediting to current accounts, including those of third persons; receiving and making payments and(or) money transfers using a current account,

including a bank account; receiving cash for making payments without opening the sender’s bank account; making money transfers without opening a bank account; information services for current account maintenance;

21) Effecting Contracts of Insurance (Reinsurance) –effecting Contracts of Insurance (Reinsurance) as principal;

22) Carrying on Contracts of Insurance (Reinsurance) –carrying on Contracts of Insurance (Reinsurance) as principal;

23) Insurance Management –performing underwriting or administration functions for or on behalf of an insurer or captive, for the purposes of that insurer effecting or carrying out a Contract of Insurance as principal, arranging reinsurance for and on behalf of an insurer or captive for whom it is underwriting, performing underwriting or administration functions for or on behalf of a Takaful Operator or a Captive Takaful Operator, for the purposes of that Takaful Operator effecting or carrying out a Takaful Contract as principal, or arranging Retakaful for and on behalf of a Takaful Operator or captive for whom it is underwriting;

24) Takaful (Retakaful) Business –the business of conducting either or both of the following activities:

effecting Takaful or Retakaful Contracts as Principal;

carrying on Takaful or Retakaful Contracts as Principal;

25) Opening and Operating Bank Accounts – opening and operating Bank Accounts, services enabling funds to be placed on a Bank Account as well as all the operations required for operating a bank account, and(or) enabling funds withdrawals from a Bank Account as well as all the operations required for operating a Bank Account;

26) Operation of a Payment System – operation of funds transfer system with formal and standardised arrangements and common rules for the processing, clearing and(or) settlement of payment transactions;

27) Operating an Exchange – means operating a facility which functions regularly and brings together multiple third party buying and selling interests in Investments, in accordance with its non discretionary rules, in a way that can result in a contract in respect of Investments admitted to trading or traded on the facility. Operating an Exchange may include organising trades, providing technical support, and setting general rules for brokers, dealers, and other exchange participants;

28) Operating a Clearing House – operating a facility where confirmation, clearance and(or) settlement of transactions in Investments are carried out in accordance with the non-discretionary rules of the facility, under which the Person operating the facility becomes a Central Counterparty (“CCP”) or provides a bookentry Securities Settlement System (“SSS”), regardless of whether or not such a Person also operates a Central Securities Depository;

29) Operating a Loan Crowdfunding Platform includes:

operating an electronic platform that facilitates the bringing together of potential

lenders and Borrowers; administering a loan agreement that results from operating the electronic

platform; making arrangements for a lender to transfer his or her rights and obligations

under a loan agreement; 30) Operating an Investment Crowdfunding Platform includes:

operating an electronic platform that facilitates the bringing together of potential Investors and Issuers who wish to obtain funding from an Investor for a business or project; administering an Investment that results from operating the electronic platform; making arrangements for an Investor to sell an Investment;

31) Operating a Multilateral Trading Facility – operating an electronic platform which brings together multiple third parties buying and selling Investments, rights and(or) interests in Investments, in accordance with its non-discretionary rules, in a way that results in a contract in respect of such Investments;

32) Operating an Organised Trading Facility – operating an electronic platform which brings together multiple third parties buying and selling Investments, rights and(or) interests in Investments, in accordance with its discretionary rules, in a way that results in a contract in respect of such Investments; 33) Operating a Private Financing Platform includes:

operating an electronic platform which brings together multiple third parties directly or indirectly buying an instrument acknowledging or creating indebtedness arising from the supply of goods or the delivery of services; entering and(or) facilitating an entering into an arrangement with a party for the purpose facilitating the activity on operating a private financing platform whether through an intermediary investment vehicle or otherwise; holding or controlling Client Money or Arranging Custody in connection with an arrangement on operating an electronic platform, entering into an arrangement with a party for the purpose facilitating the activity on operating an electronic platform or facilitating such an arrangement mentioned in paragraphs 1-3 above

34) Operating a Digital Asset Trading Facility – means operating a facility which functions regularly and brings together multiple parties (whether as principal or agent) with a view to enter into contract (a) to buy, sell or exchange Digital Assets for a money (Fiat currency); and/or (b) to exchange one Digital Asset for another Digital Asset, in its Facility, in accordance with rules of the operator of the Digital Asset Trading Facility.

6. AIFC participant that provides financial services, which are exempt from corporate income tax and value-added tax, is obliged to perform its main activities on the territory of the AIFC during the entire relevant tax period in compliance with the requirements for actual presence determined by the AIFC Act in coordination with the state authority responsible for collection of taxes and other mandatory payments to the budget (if necessary). -

Chapter 4. Procedures for applying the List

7. For the application of the List, in part that does not contravene the Constitutional Statute and not regulated by the List, AIFC Bodies may:

1) make amendments to the List by approving a Joint Order in accordance with subparagraph 5) of paragraph 3 of article 6 of the Constitutional Statute;

2) adopt AIFC Acts related to the application of the List and / or terms used in the List, in agreement with the state authority responsible for collection of taxes and other obligatory payments to the budget;

3) within the scope of competence to provide clarifications and comments on the application of the List;

4) provide assistance to the AIFC Participants and applicants by conducting seminars, meetings, meetings, in obtaining information on a free basis through Internet resources, posting information using mass media, information stands, booklets and other printed materials, as well as video, audio and other technical means used for the dissemination of information.