AIX presents its results for 2024

Astana International Exchange (“AIX” or “the Exchange”) is proud to present its 2024 performance highlights, underscoring a year marked by transformative innovation and substantial growth in the capital markets.

Throughout 2024, AIX launched a series of groundbreaking and market-first initiatives designed to meet the dynamic needs of businesses and investors. These initiatives have not only broadened access to capital but have also reshaped Kazakhstan’s investment landscape setting new standards for market excellence. By fostering meaningful engagement with market participants and consistently addressing their evolving requirements, AIX remains at the forefront of delivering innovative business–focused solutions that drive sustainable growth and long-term value creation.

Assel Mukazhanova, AIX CEO, said:

“2024 has been a breakthrough year for AIX, surpassing all previous milestones and setting a new benchmark for our growth and impact. It was a year defined by unprecedent achievements that have reshaped the financial landscape for Investors and Issuers in Kazakhstan and beyond. Our unwavering commitment to innovation, sustainability, and expanding accessibility has unlocked new opportunities, driving economic growth and fostering financial inclusion. As we continue to empower businesses and investors with diverse and forward-thinking solutions, we remain dedicated to building a dynamic and resilient capital market that anticipates and meets the evolving needs of all AIX stakeholders.”

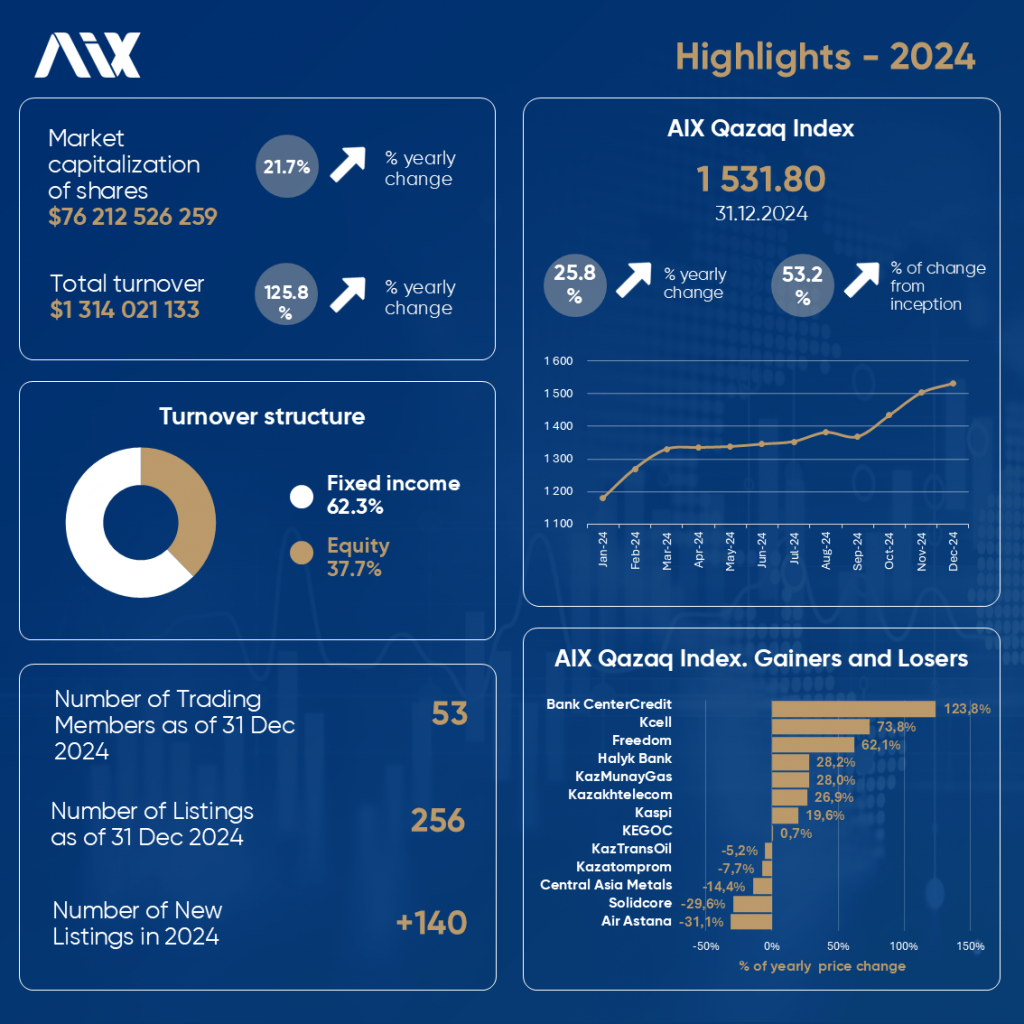

AIX results as of 31 December 2024:

- Securities listings: 256 securities listed by 148 issuers overall. For FY2024 – 140 listing done by 68 issuers.

- Capital raised: (Debt + Equity): $7.0bn since inception; $2.3bn for 2024.

- Trading turnover: More than doubled, from $582m in 2023 to $1.3bn in 2024.

- Market participants: 53 trading members, including brokers from Kazakhstan, China, Europe and Middle East – 19 new brokers were onboarded in 2024. Ten global custodians maintain sub-accounts at the AIX Central Securities Depository (AIX CSD).

- Investor accounts: Over 1.9m retail investors’ accounts with AIX CSD, having grown from 1.5m in 2023.

Trading Highlights

Equity trading volume reached $495m, with more than 80% attributable to three stocks, with the following split:

- Solidcore Resources plc: 52%

- Air Astana: 19%.

- Kazatomprom: 9%.

The percentage of debt in total turnover was down to 62% at YE2024from 78% in the previous year. Trading in structured products amounted to $2m with a solid pipeline for 1Q2025.

Block trading (negotiated deals) has seen notable growth in 2024 with 23 such transactions taking place in shares of Solidcore Resources plc and Air Astana, along with Black Sea Trade and Development Bank bonds.

The AIX Qazaq Index has recorded a 26% increase reflecting the positive market momentum. Additionally, AIX Qazaq Index has expanded to include KEGOC, Air Astana, and Freedom Holding stocks, further enhancing its representation of the market.

AIX listings in 2024

The number of listings in 2024 was a record high at 140. Bond placements remained robust as companies sought alternative financing for growth amid tightening access to traditional capital. Liquidity management programs accounted for 40% of all listings.

- Kazakhstan’s first sukuk: Issued by Gamma-T SPC Limited, marking a milestone in Islamic finance. By facilitating the listing of debut local sukuk, we are creating more diverse and inclusive investment opportunities and strengthening our link to global Sharia-compliant financial markets.

- Debut green bonds of a regional market issuer: By PlanDeM LLC, the first issuer from Kyrgyzstan, fostering sustainable investments in the region. The Green Wholesale Bond Programme registered by the company facilitates allowing future issuances in various currencies and maturities.

- Sovereign Eurobond: $1.5bn benchmark issuance by the Ministry of Finance of Kazakhstan, dual-listed on AIX and the London Stock Exchange, with strong local investor participation. The Eurobonds amounting to US$1.5bn carry a coupon rate of 4.714% p.a. and have been offered on both AIX and the London Stock Exchange (LSE). The volume of orders on AIX for the Eurobonds amounted to $322m. As a result of the allocation, AIX investors have received Eurobonds worth $189.37m.

New products and services

- Renewable energy certificates (I-REC): Launched in September 2024 to support sustainable energy initiatives. The I-REC certificate confirms that the energy was produced from renewable sources and corresponds to 1 MWh of clean electricity. By adding products like I-REC certificates alongside our conventional capital market offerings, we help companies to meet their environmental goals while maintaining financial performance.

- Green equity framework: AIX adopted the World Federation of Exchanges’ standards, enhancing visibility for green issuers and aiding environmentally conscious investors. The AIX Green Equity Principles and Guidelines offer issuers a clear opportunity to strengthen their reputation as green businesses, capitalizing on the increasing focus on environmental sustainability.

- Fund listings expansion: Inclusion of Exempt Funds and Central Asia’s first publicly listed ETF. These instruments can be purchased by accredited investors on AIX’s main market.

- Free-float threshold reduction: Lowered from 25% to 10%, simplifying issuer access and enhancing market liquidity.

- Expanded custody services: AIX CSD now offers custody for international Euroclearable fixed-income securities and KCSD-registered instruments. The new custody service is a perfect fit for small to medium-sized fund managers and broker-dealers who do not have the critical asset mass to have a direct account with an ICSD or a Global Custodian. It also offers the operational convenience of holding all securities admitted to the AIX Official List and/or to trading on other regulated markets under a single roof.

- Registrar services: The AIX Registrar enjoyed an unprecedented growth of its activities while expanding into new areas. In addition to the Issuers of AIFC-registered securities, 26 funds have chosen the AIX Registrar to maintain the registry of their unit holders. The AIX Registrar routinely processes proxy voting and offers investors and issuers access to its online portal.

Retail investors

The number of local investor accounts increased from 1.5m in 2023 to 1.9m accounts in 2024.

The Tabys App, AIX’s mobile application, introduced a new financial instrument for its users, expanding its product range with bonds from Solva Group Ltd., one of Kazakhstan’s largest microfinance organizations. The app’s direct subscription, launched in 2022, was first used during the IPO of the national company KazMunayGas and later for KEGOC’s SPO and Air Astana’s IPO.

In 2024, Exchange Traded Notes (ETNs) traded (buy-sell) through the Tabys mobile app were $26.8m worth compared to $5.4m in 2023, with funds under management totaling $6.5m and active investors reaching 20 thousand individuals.

International cooperation

AIX strengthened ties with the Gulf Region countries through a partnership with Muscat Stock Exchange. This collaboration is set to enhance market liquidity and streamline trading mechanisms by facilitating cross-trading via Tabadul Trading Platform, created by the Abu Dhabi Stock Exchange. Tabadul allows exchanges to trade directly with each other through licensed brokers, as well as make investments between countries at the regional and global levels. The Bahrain Stock Exchange, Central Asian Stock Exchange (Tajikistan) and Muscat Securities Market (Oman) are already members of Tabadul.

As of the end of 2024, Freedom Finance Global and Halyk Finance have been recognized as Tabadul Hub brokers from Kazakhstan, and three UAE brokers have joined as AIX trading members, making the cross-exchange trading between AIX and ADX available.

Reference:

AIX was formed in 2017 within the Astana International Financial Centre development framework. AIX shareholders are AIFC, the Shanghai stock exchange, the Silk Road Fund, and NASDAQ, which also provides the AIX trading platform. The exchange operates within a regulatory environment based on the principles of English Law, thus providing a reliable investment environment. The mission of AIX is to develop an active capital market in Kazakhstan and the region by providing clear and favorable conditions for attracting financing to private and public businesses. AIX develops special segments for mining companies as well as infrastructure projects under the Belt and Road initiative. www.aix.kz

The Astana International Financial Centre (AIFC) is an independent jurisdiction that started (AIFC) is an independent jurisdiction with a favourable legal and regulatory environment and a developed infrastructure for starting and doing business, attracting investment, creating jobs and developing Kazakhstan’s economy. https://aifc.kz/