Astana International Financial Centre Showcases Investment Opportunities in Beijing

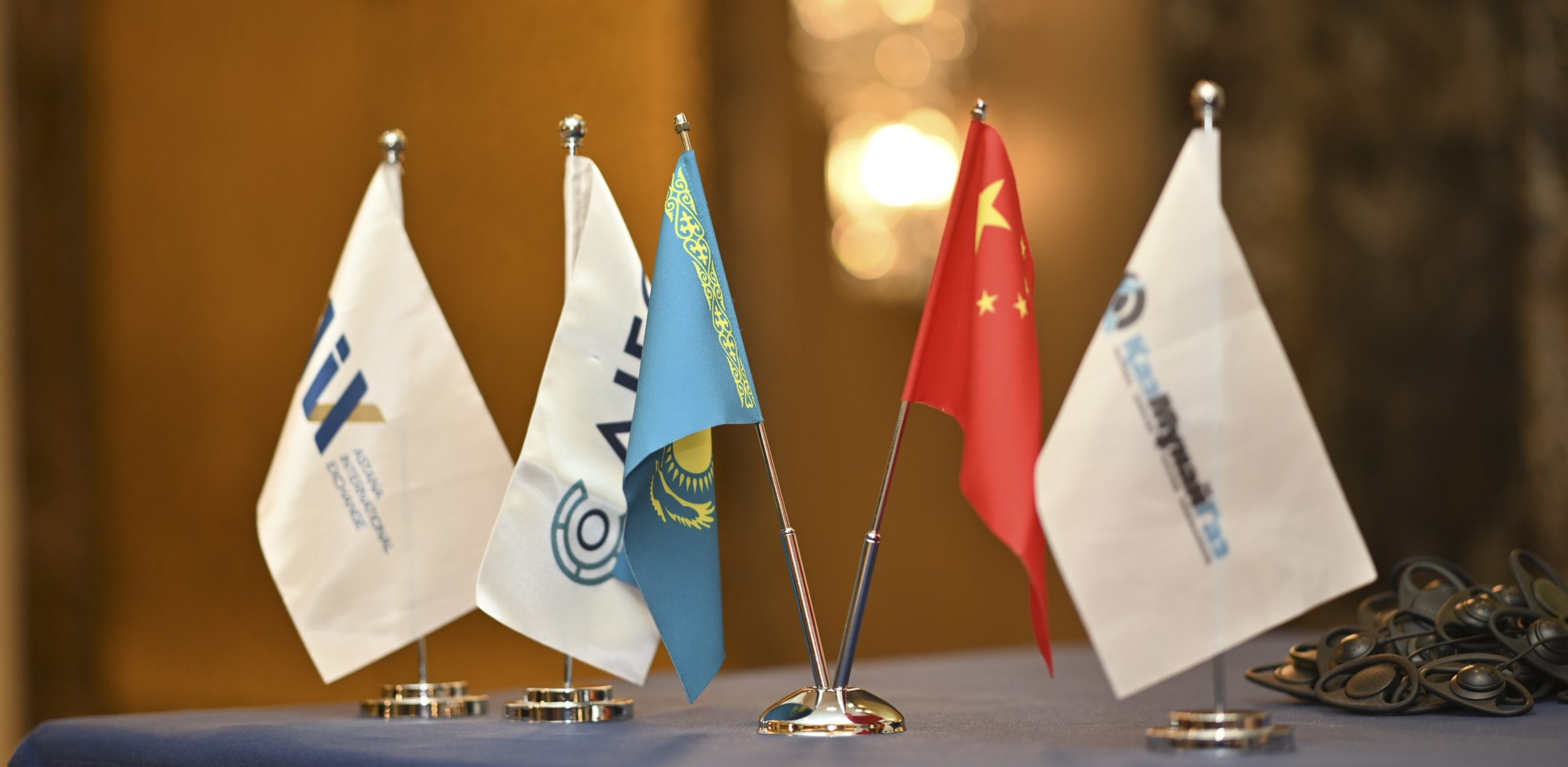

On 28 August, the Astana International Financial Centre (AIFC) hosted a business event, AIFC Connect, in Beijing. The primary aim was to present the Centre`s investment potential to Chinese entrepreneurs and financial institutions, laying the groundwork for new partnerships and attracting foreign business to Kazakhstan. The event, organised with the support of the Embassy of the Republic of Kazakhstan in China and in partnership with the national company KazMunayGas, brought together over 100 representatives from Chinese firms, including senior management from investment companies, banks, asset managers, and other financial institutions.

The event opened with a welcoming address from Kuanysh Amantay, Minister-Counsellor at the Embassy of Kazakhstan in the People’s Republic of China. In his remarks, he emphasised the strategic nature of bilateral relations and the dynamic growth of trade and economic ties between the two nations, a trend confirmed by official statistics: “China consistently ranks among the top five investors in Kazakhstan`s economy. Kazakhstan is China`s largest trading partner in Central Asia. Last year, bilateral trade reached nearly USD 44 billion. Both the volume and diversity of Kazakh exports to China are increasing, contributing to the diversification of our export structure. Investment cooperation is actively developing. An intergovernmental mechanism for supporting joint investment projects is in operation. Each year, the number of new sectors in which the two sides implement investment projects continues to grow. Priority is given to projects aimed at developing Kazakhstan`s processing, deep processing, and manufacturing industries. According to estimates, more than 220 different projects involving Chinese investors are currently being implemented in Kazakhstan, with a total value exceeding USD 66 billion. One such joint project implemented in Kazakhstan is today undergoing a dual listing on the stock exchanges of Hong Kong and Astana. This development opens up new opportunities for companies from both countries that are implementing or considering joint investment projects and undoubtedly enhances Kazakhstan`s investment appeal”.

The event featured a live broadcast of the dual listing of shares by mining company Jiaxin International Resources Investment Limited on both the Hong Kong Stock Exchange (HKEX) and the Astana International Exchange (AIX).

Jiaxin International Resources, a Hong Kong-based company, operates the Boguty tungsten deposit in the Almaty region through its subsidiary, Zhetysu Wolfram LLP. The deposit is one of the world’s largest reserves of tungsten oxide, with estimated resources of 107.5 million tonnes of ore. Proceeds from the share placement will be used to expand production capacity, build deep processing facilities, and develop new non-ferrous metal projects in Central Asia.

The business programme continued with presentations from a range of speakers. These included Temirlan Mukhanbetzhanov, Advisor to the AIFC Governor; Zharas Mussabekov, Chief Financial Officer of the Astana International Exchange; Diana Aryssova, Deputy Chairperson of the Management Board of JSC NC KazMunayGas; Zhu Sheng, Executive Director of the Shanghai Stock Exchange; Barry Chan, Managing Director of CICC; among others. The speakers highlighted the opportunities offered by the AIFC, Kazakhstan’s investment potential, and prospects for cooperation between Kazakhstan and China.

Temirlan Mukhanbetzhanov, Advisor to the AIFC Governor, noted: “In today’s complex global economic environment, stable, predictable, and transparent conditions for doing business are becoming increasingly important for entrepreneurs worldwide. The Astana International Financial Centre offers precisely such conditions, serving as an efficient and accessible platform for structuring deals, attracting capital, and delivering large-scale projects. This is particularly relevant in the context of infrastructure development plans under the ‘Middle Corridor’ and the growing industrial cooperation of interest to Chinese businesses.”

Diana Aryssova, Deputy Chairperson of the Management Board of JSC NC KazMunayGas, said that, as of today, the KMG group of companies covers the entire production cycle: geological exploration, extraction, processing, transportation, as well as oil and gas chemistry. The company accounts for 27% of the country’s total oil production, 57% of oil transportation, and 80% of oil refining.

“The operational and financial efficiency of KazMunayGas has been recognised by leading international rating agencies. Today, ratings from all three agencies are at investment grade and match the sovereign ratings of the Republic of Kazakhstan. The company follows a balanced financial policy and meets all its obligations in a timely manner, confirming its reliability and strong creditworthiness,” – Aryssova said.

Zharas Mussabekov, Chief Financial Officer of Astana International Exchange, said: “Today marks a historic milestone for the stock markets of Kazakhstan and China – the mining company Jiaxin International Resources has conducted an IPO simultaneously on the Hong Kong Stock Exchange and the Astana International Exchange (AIX). This is the first dual listing on the stock exchanges of the two countries, the first IPO under the Belt and Road segment, and the first yuan-denominated IPO in Central Asia. We hope that other issuers looking to tap into the potential of both markets will follow Jiaxin International Resources”.

By mid-August, 835 companies with Chinese capital were registered under the jurisdiction of the AIFC. Of these, around 200 became new participants in the first seven months of this year alone. These companies operate across sectors such as trade, ICT, financial services and insurance, manufacturing, mining, professional, scientific and technical activities, transport, logistics, and construction.

It is worth noting that the Astana International Financial Centre (AIFC), according to the GFCI ranking, holds a leading position among financial centres in the Eastern Europe and Central Asia region. Since its launch in 2018, the AIFC platform has attracted over US$17 billion in investment to the Kazakhstani economy. More than 4,200 companies from 85 countries – including the United States, United Kingdom, China, Hong Kong, Turkey, South Korea, Singapore and others – are registered under the AIFC’s jurisdiction.

Reference:

The Astana International Financial Centre (AIFC) is a leading financial hub in the Eastern Europe and Central Asia region, designed to connect global capital with the vast opportunities of emerging markets. Positioned at the crossroads of Europe and Asia, the AIFC combines international best practices with innovative approaches to create a world-class platform for investment, business, and financial services.

AIFC Connect is a format of exclusive meetings where experts and top executives from the financial and industrial sectors are introduced to the initiatives of the AIFC and the investment opportunities in Kazakhstan for doing business. Previously, AIFC Connect was held in Singapore in 2023, in London and Dubai in 2024, and in Seoul and Hong Kong in 2025.