How can Kazakhstan improve its carbon regulation system? AIFC report

Experts from the Astana International Financial Centre (AIFC) have prepared a report titled “Emissions Trading Systems and the Voluntary Carbon Market: Global Overview and Prospects for Kazakhstan.” The document explores these critical aspects of building a green economy, with a particular focus on Kazakhstan.

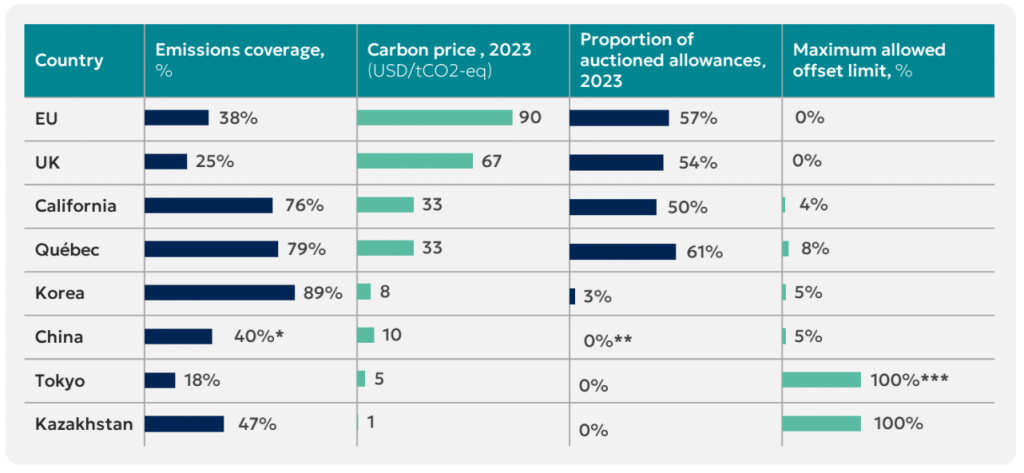

International experience demonstrates that emissions trading systems (ETS) in developed and industrially emerging countries operate on a model of the partial distribution of allowances through auctioning, which helps establish a market price for carbon.

Fig. 1. Key Carbon Market Indicators by country

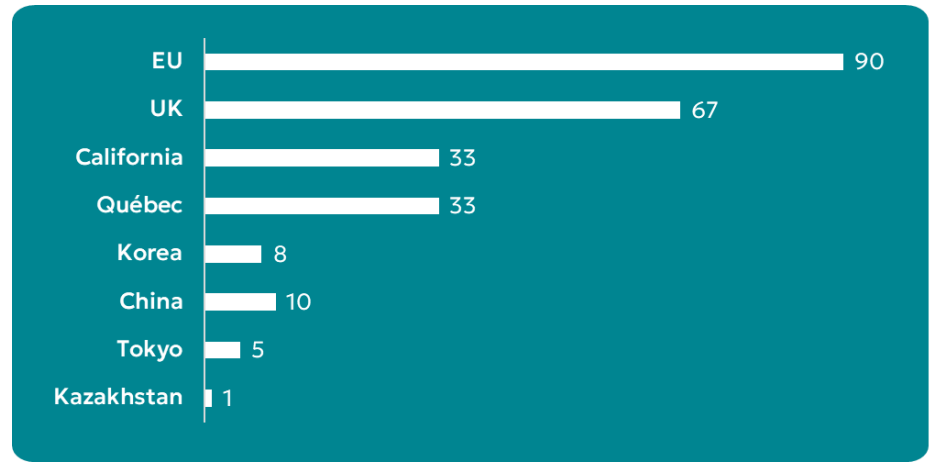

In Kazakhstan, the national Emissions Trading System (Kaz ETS) was launched in 2013 and currently covers 47% of emissions, generated by 135 companies from the energy, mining and manufacturing sectors. However, all allowances are allocated free of charge, resulting in a low average carbon price. The cost of one carbon unit in Kaz ETS is approximately USD 1 – significantly lower than in comparable systems, such as the European ETS, where prices reached USD 90 in 2023.

Fig. 2. Carbon unit prices in 2023, USD per tCO₂-equivalent

Additionally, carbon trading in Kazakhstan has been suspended since 2022, whereas the effective operation of an ETS is a key driver for decarbonization.

As part of the report, AIFC experts analyzed the efficiency of Kaz ETS. Based on this assessment, they identified key barriers hindering its effectiveness and provided recommendations for its improvement.

These recommendations include introducing of paid allocation of carbon allowances, expanding trading opportunities across multiple platforms, expanding the coverage of ETS participants and creation of a carbon fund.

Developing Kazakhstan’s carbon market is essential for the country to achieve carbon neutrality by 2060 and fulfill its international commitments to reducing greenhouse gas emissions.

The report also outlines the vision for the development of the AIFC Carbon Platform for environmental financial instruments. In the medium term, the platform aims to facilitate carbon credit trading, while in the long run, it could serve as a marketplace for emissions allowances within Kaz ETS. The AIFC Carbon Platform has the potential to expand and transform into a regional hub for Central Asia and the Caucasus.

Daniyar Kelbetov, Chief Product Officer at AIFC Authority, commented: “At the Astana International Financial Centre, we are committed to leading the development of new market mechanisms and financial products that not only drive economic growth but also contribute to global sustainability efforts. Our advanced infrastructure and technological capabilities serve as the foundation for these initiatives, positioning the AIFC as a platform for sustainable investments and innovative financial solutions.“

The full version of the report is available here.

About AIFC

The Astana International Financial Centre (AIFC) is an independent jurisdiction offering a favorable legal and regulatory environment, as well as a developed infrastructure for business establishment, investment attraction, job creation, and economic growth in Kazakhstan. www.aifc.kz