The reserves of critical raw materials allow Kazakhstan to become a leading supplier in the energy transition

Kazakhstan can ensure the uninterrupted supply of critical minerals and help meet the growing global demand associated with the energy transition and the development of the electric vehicle market. Nine groups of goods have export potential, including metals already exported by Kazakhstan and those whose full potential has yet to be realized, namely lithium, nickel, gold and rare-earth metals. Such conclusions were presented by experts of the Administration of the Astana International Financial Centre (AIFC, the Centre) in an analytical overview of the mining industry in Kazakhstan.

According to the overview, the energy transition and rapid development of the electric vehicle market will significantly increase the global growth in demand for critical minerals. Kazakhstan has abundant resources, including those critical for low carbon development.

Kazakhstan has demonstrated comparative advantages in the world market by exporting copper, zinc, aluminium, silver and lead. At the same time, gold, nickel, lithium and rare-earth metals have been assessed as potential resources for nascent exports that could give Kazakhstan an advantage in the global market.

Metals considered in the overview are derived from the results of report on Kazakhstan’s economic complexity that was developed by AIFC and Harvard Growth Lab. The report constituted a list of product recommendations including two groups: existing products as exports to be expanded, and new and nascent products as exports to be developed. Products were assessed on feasibility factors and attractiveness factors and those with highest overall score were selected.

According to the report, Kazakhstan currently has a comparative advantage in exporting the following metals:

Zinc. Kazakhstan’s share in the global market of zinc is almost 5%. In 2023, Kazakhstan had the 7th largest reserves in the world with 6.7 million tonnes. In 2022, top-3 destinations of Kazakhstan’s exported zinc were Turkey, Russia, and China that constitute almost 70% of Kazakhstan’s zinc exports.

Copper. Kazakhstan’s share in the global market of copper is almost 4%. In 2023, Kazakhstan had the 11th largest reserves in the world with 20 million tonnes. In 2022, top-3 destinations of Kazakhstan’s exported copper were China, Turkey, and the UAE.

Lead. Kazakhstan’s share in the global market of lead is almost 3%. In 2021, Kazakhstan had the 8th largest reserves in the world with 2 million tonnes and the 12th largest mine production with 40 000 tonnes. Global annual demand for lead is expected to increase from current 11.6 million tonnes in 2022 to 13.4 million tonnes by 2031.

Silver. Kazakhstan’s share in the global market of silver is about 2.7%. According to Kazakh Invest, Kazakhstan has the 3rd largest silver reserves in the world. The current annual demand for silver is about 26 thousand tonnes, 4 thousand tonnes of which are used in green energy sector. Under the Net Zero Emissions Scenario, green demand for silver might increase from current 4 thousand tonnes to 9 thousand tonnes by 2030.

Aluminium. Kazakhstan’s share in the global market of aluminium is less than 1%. In 2023, Kazakhstan had the 11th largest reserves of bauxites in the world with 160 million tonnes and the 10th largest mine production with 4.3 million tonnes. In 2022, top-3 destinations of Kazakhstan’s exported aluminium were Turkey, Italy, and Greece.

Export-oriented metals whose potential is yet to be unlocked according to the report:

Nickel. Kazakhstan’s share in the global market of nickel is negligible and close to 0% despite the fact that Kazakhstan is in the top 20 countries in terms of nickel reserves with about 1.5 million tonnes or 2% of the global total. Global annual demand for nickel is expected to increase from current 3 million tonnes to 3.9-5.8 million tonnes by 2030 and to 4.8-6.5 million tonnes by 2050.

Lithium. Depending on the green scenario, global annual demand for lithium is expected to increase from 130 thousand tonnes in 2022 to 312-721 thousand tonnes by 2030. Kazakhstan’s geology services have been partnering with companies from Germany, South Korea, and the UK to explore and develop lithium fields in East Kazakhstan. In March 2024, Korean Institute of Geoscience and Mineral Resources discovered a new lithium deposit with a grade of 5.3% in East Kazakhstan. It may be worth $15.7 billion.

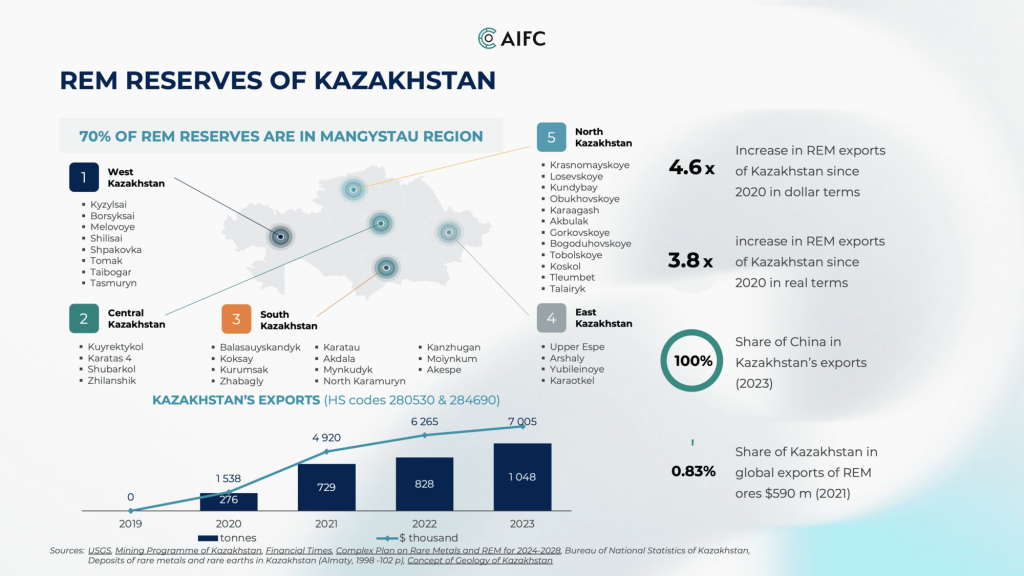

Rare-earth metals (REM). Kazakhstan experienced a 4.6-fold increase in REM exports since 2020 in dollar terms, and a 3.8-fold increase in REM exports since 2020 in real terms. In December 2023, Kazakhstan adopted a Complex Plan on REM for 2024-2028. According to the document, Kazakhstan is planning to invest KZT 2.4 billion (~$5.3 million) in the development of rare metals and REM in 2024-2028. In May 2024, the Senate of Kazakhstan declared that potential rare metals and REM resources of Kazakhstan might include about 5 000 deposits worth $46 trillion.

Gold. Even though Kazakhstan had the 14th largest reserves in the world and the 7th largest gold mine production in 2022 (according to the USGS). According to official statistics, Kazakhstan’s share in global exports is less than 1%. For the last 10 years, the global annual demand for gold is stable around 4.4 thousand tonnes.

Kazakhstan plans to be not only a supplier of critical raw materials but also to become an integral part of the supply chain with certain production processes carried out in the country. This requires actively engaging the private sector – both domestic and foreign. Since 2005, around 16.4% ($67 billion) of cumulative FDI to Kazakhstan has been related to the metal industry, which also includes critical minerals.

The AIFC serves as an investment platform for large-scale projects in the Central Asian region. The centre facilitates major transactions in both the public and private sectors, including Kazakhstan’s mining industry. The centre offers local and foreign investors a predictable and sustainable regulatory environment as well as facilitates business by maintaining the safety and robustness of the financial infrastructure.

You can explore the overview further by accessing it through this link.

Reference:

The Astana International Financial Centre (AIFC) is an independent jurisdiction with a favourable legal and regulatory environment and a developed infrastructure for starting and doing business, attracting investment, creating jobs and developing Kazakhstan’s economy. www.aifc.kz

Contact information for inquiries:

Ainur Issabayeva

Press secretary of AIFC

Mob: +7 701 777 65 58

E-mail: pr@aifc.kz