Renewables in Kazakhstan: Current State, Potential and Financing Mechanisms

The primary objective of this report is to inform the general public about the importance of transitioning to clean energy and the state of the renewable energy industry in the country. Additionally, it aims to provide potential investors with insights into financing renewable energy (RE) projects, including the issuance of green bonds on the Astana International Financial Centre (AIFC) platform, supported by the AIFC Green Finance Centre (GFC).

One of the leading sources of greenhouse gas emissions and air pollution worldwide is the energy sector, responsible for approximately 75% of all greenhouse gas emissions in Kazakhstan. Kazakhstan has committed to reducing greenhouse gas emissions as part of the Paris Agreement and has adopted a strategy to achieve carbon neutrality by 2060. Decarbonising the economy, including transitioning to renewable energy sources, can significantly contribute to achieving these goals.

Renewable energy sources (RES) like solar, wind, and hydropower produce electricity while emitting minimal to no CO2, rendering them essential elements in the process of reducing carbon emissions. The global adoption of RES is currently accelerating. For instance, in 2022, RES accounted for 83% of the total installed capacity added worldwide, showcasing its rapid growth.

The Government of Kazakhstan actively supports RE projects by implementing a single electricity purchase system for renewables, offering tax and customs incentives, and providing state natural grants. As of the end of the first half of this year, the country has 133 renewable energy facilities with a combined installed capacity of over 2,500 MW. The introduction of an auction bidding mechanism in 2018 has increased investor demand for RE projects. An additional 6,770 MW of installed renewable energy capacity is planned to be auctioned between 2023 and 2027.

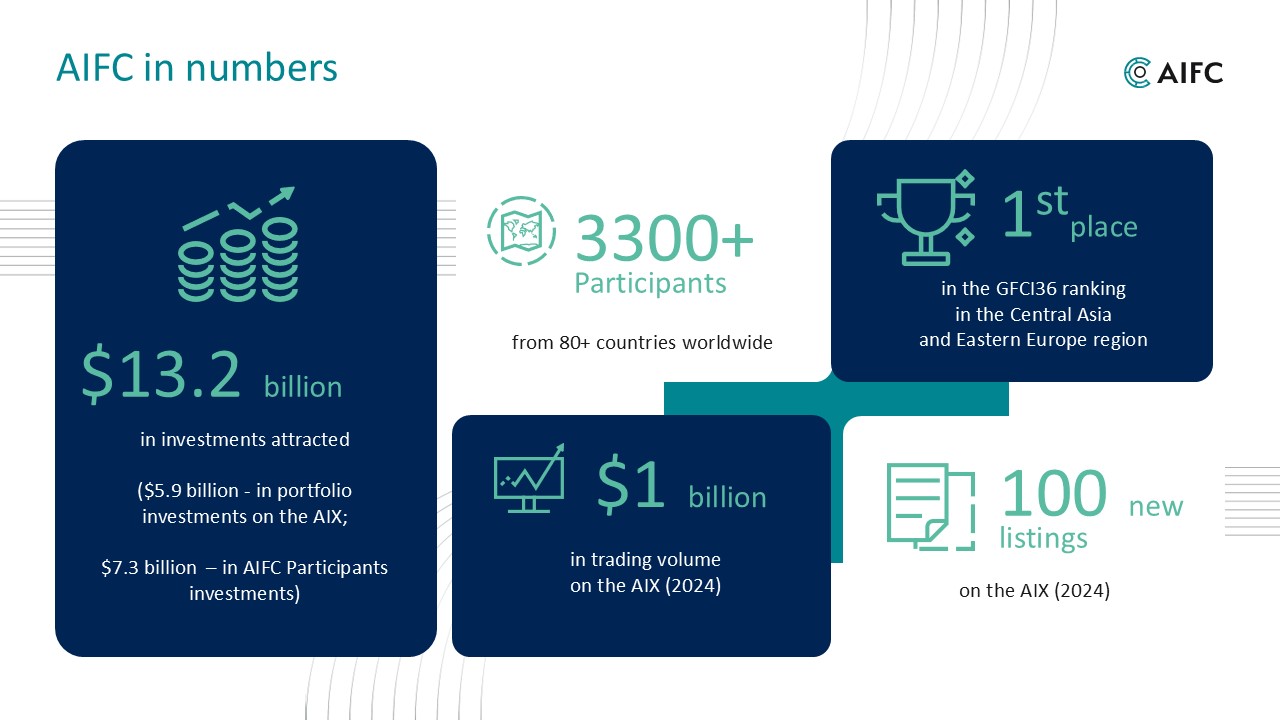

One of the key objectives of the AIFC is to promote sustainable development goals, including the transition to a low-carbon economy, attracting green investments, and creating a supportive financial ecosystem.

The AIFC Green Finance Centre was established to advance green and sustainable finance in Kazakhstan and Central Asia. It is currently the only verifier in the region recognized by the International Capital Markets Association (ICMA) and the Climate Bonds Initiative (CBI). Over the past three years since the first issuance of green bonds, the green finance market has grown to 169 billion tenge, with two-thirds of it verified by the GFC. Green bonds are primarily issued for renewable energy projects in the country. More details on the status of renewables in the country and green bond issuance for renewable energy projects supported by the GFC can be found at this link.