AFSA hosts training on sanctions for compliance community

A “Sanctions Training: International and Regional Insights” has taken place at the Astana International Financial Centre (AIFC). The workshop convened a community of compliance and anti-money laundering (AML) professionals from amongst the AIFC participants and beyond. It focused on the sanctions regimes implemented by the UK and US.

The event was organised by the British Embassy in Astana, the Astana Financial Services Authority (AFSA), Eldwick Law, Outer Temple and Unicase Law Firm.

The training was designed to arm employees with the knowledge and skills necessary to adapt effectively to ongoing changes. It covered such topics as designated persons, ownership and control, financial and trade sanctions, enforcement and compliance within the UK context, the role of sanctions in litigation and arbitration as well as provided an overview of secondary sanctions in the US context.

Managing Partner at Unicase Law Artem Timoshenko: “I find the topic of the training most relevant and interesting because economic sanctions as a type of government policy is one of the most problematic themes in the context of international relations. Nowadays we can observe that most countries don’t have any specific national legislation to define the rules of behavior within the country to comply with the sanctions regime and not to fall under secondary sanctions, but there are lots of obligations for non-sanction countries such as following the new rules of trade. Due to increasing demand from clients to Unicase for compliance with and understanding of economic sanctions I am convinced that it is a great opportunity for local business to establish new methods and due-diligence algorithms.”

Barrister at Outer Temple Chambers Alex Haines: “The training is designed to assist the participants in making their day-to-day practice more efficient so that they can provide better value to their clients.”

Rashid Gaissin, Partner at Eldwick London Office: “I travelled across the region intensively including Kazakhstan, Uzbekistan, Turkey, and the United Arab Emirates over the last 10 months. We were asked everywhere about the sanctions, their application, consequences for non-compliance etc. We thought it would be great to put together the training on sanctions to get to the bottom of many tricky issues hence the idea of what we plan to discuss now in Astana”.

AIFC’s AML/CFT and Sanctions systems and controls are risk-based supervision model comprising the main lines of prevention and protections, such as conducting due diligence and disclosure of ultimate beneficial ownerships at registration and authorisation stages; firms’ managers are examined for professional compliance while Money-Laundering Reporting Officers are interviewed to ensure they are fit and proper; firms are assigned appropriate risk ratings and, if necessary, prescribed “Risk Mitigation Programmes” (RMP), which is a list of requirements and recommendations for an applicant firm. Only after the firm’s mandatory fulfillment of their RMP it can proceed to operating at AIFC. Subsequently, firms are placed under the supervision of case managers who conduct ongoing monitoring, with remote and on-site scheduled or unscheduled inspections. It is important to note that AFSA has sufficient powers, including the right to demand any information and to impose various disciplinary and financial sanctions of a proportionate nature for non-compliance with AIFC’s AML/CFT requirements.

AFSA Chief Executive Officer Nurkhat Kushimov: “Gaining regional and international insights into sanctions helps boost protections against sanctions risks. By sharing expertise and experience with respect to sanctions regimes that are developing at such a rapid pace as today we help ensure that jurisdictions continue to deliver fair and transparent financial and capital markets.”

Reference:

The Astana Financial Services Authority (AFSA) is the independent regulator of the Astana International Financial Centre (AIFC), which is established in accordance with the Constitutional Law of the Republic of Kazakhstan “On the Astana International Financial Centre” for the purposes of regulating financial services and related activities in the AIFC. AFSA administers the AIFC Regulations and Rules and is responsible for the authorisation, registration, recognition and supervision of financial firms and market institutions in the AIFC.

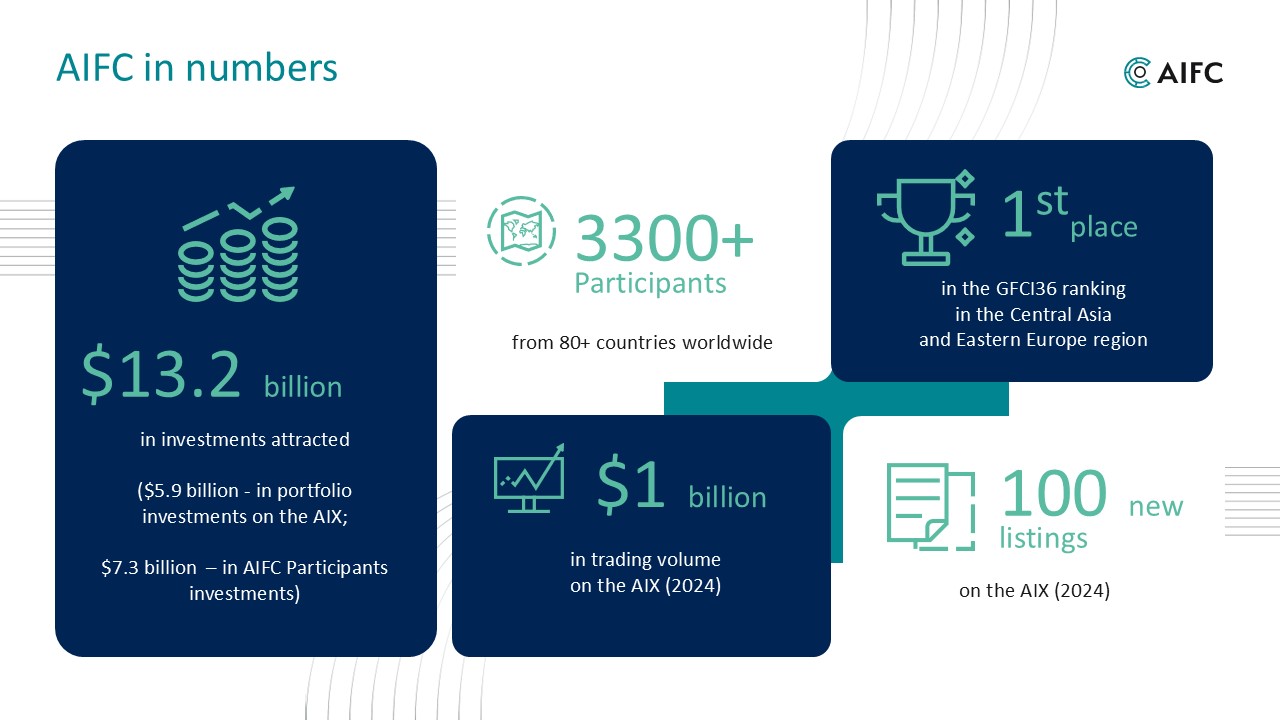

Over 2,700 firms from 78 countries are registered in the AIFC. These firms provide banking, insurance, investment, professional and other services. The range of financial services offered at the AIFC is comparable to the list of services available in long-established financial centers of the world, such as London, Hong Kong, Singapore, Dubai and others. www.afsa.kz

The Astana International Financial Centre (AIFC) is an independent jurisdiction with a favourable legal and regulatory environment and a developed infrastructure for starting and doing business, attracting investment, creating jobs and developing Kazakhstan’s economy. https://aifc.kz/

Contact information:

Public Relations and Communications Division of AFSA: +7 (717) 264 73 43; +7 7172 61-37-45 email: [email protected]